With the US dollar (UUP) tipped to strengthen considerably under President-elect Donald Trump's administration, we feel stocks with largely domestic operations will outperform those with significant international operations over the next 12 months due to currency headwinds. With 4,712 stores based across 45 U.S. states, O'Reilly Automotive (NASDAQ:ORLY) is a stock we believe could prove to be a great investment today.

Not only will O'Reilly Automotive be safe from currency headwinds due to having its operations wholly within U.S. borders, unlike rival AutoZone (AZO) which has approximately 9% of its stores in Mexico, but the company also stands to benefit from lower import costs, thanks to the strong dollar. Although O'Reilly Automotive doesn't state the proportion of its products which are imported, considering the overlap in product assortment and strikingly similar gross margins, we feel it is safe to presume it will be comparable to AutoZone. As per its 10K, AutoZone sources 10% of its products from overseas, whilst acknowledging that "many of our domestic vendors directly import their products or components of their products."

If the dollar at least remains at the current level, then we expect both companies should see gross margins continue to climb higher over the next 12 months, breaking through the 53% mark. O'Reilly Automotive is well on its way. In the third quarter, its gross margin was 52.68%, 30 basis points higher than its trailing gross margin of 52.38% shown above.

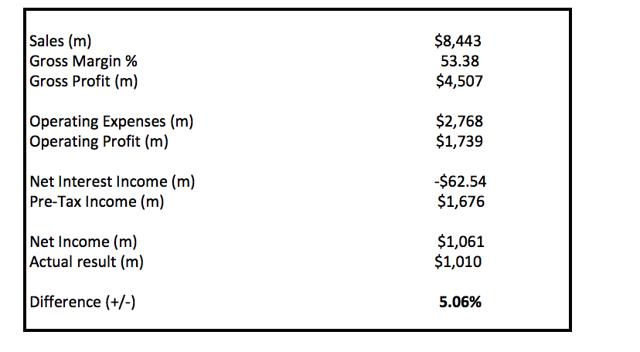

Based on its trailing 12-month performance, a 1% rise in O'Reilly Automotive's gross margin would be roughly the equivalent to a 5% increase in net profit as the calculations below demonstrate.

Source: Company data, author calculations.

If there's one thing we like in an investment, it is increasing levels of profitability. O'Reilly Automotive certainly provides investors with this.

But the dollar isn't the