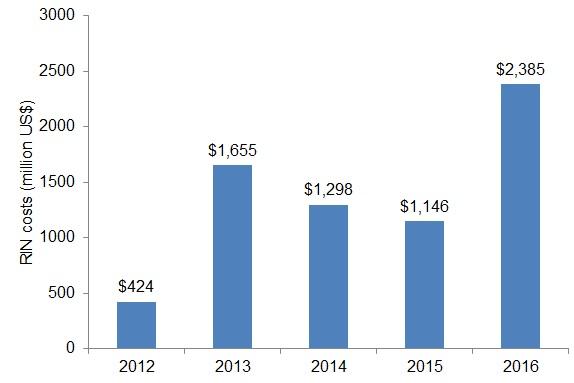

The end of Q4 earnings season has made it possible to take a full tally of how much merchant refiners spent on the biofuel blending credits known as "Renewable Identification Numbers" (RIN) in calendar year 2016. The good news for the sector is that the combined cost reported by the merchant refining sector - Alon USA Energy (ALJ), Calumet Specialty Products Partners (CLMT), CVR Refining (CVRR), Delek US Holdings (DK), HollyFrontier Corp. (HFC), Marathon Petroleum (MPC), PBF Energy (PBF), Tesoro (TSO), Valero (VLO), and Western Refining (WNR) - plus Delta Air Lines (DAL), which owns a refinery - was less than the $2.5 billion that was projected last August. At $2.4 billion, however, it did not miss by much, and the annual result represented a 108% increase over the total for the same firms in 2015 (see figure) - although it should be noted that the 2015 figure does not include a number for HollyFrontier, which I was unable to find. Even accounting for this discrepancy, however, the total expenditure in 2016 was roughly twice that in 2015.

Sources: Annual earnings reports and earnings calls (2017).

This result was not surprising given the behavior of RIN prices in 2016 and the rising nature of the volumetric mandate that the RINs support. RIN prices moved sharply higher over the course of the year, achieving averages in Q3 and Q4 that were approximately 31% higher than the average in Q1 for D6 RINs, which are the least expensive of the three categories for which prices are widely available. Furthermore, the total blending volume required by the U.S. Environmental Protection Agency [EPA] for 2016 of 18.11 billion gallons represented an increase of 7% YoY, meaning that the total volume of RINs in the market increased by a similar amount (each RIN represents one gallon of ethanol-equivalent