China’s Strict Rules Could Impact Related ETFs

China is on everyone’s minds these days as the country gears up for its Olympic Games next week, and many are looking for ways the country’s activity could boost related ETFs.

But are tightening rules for businesses hurting them ahead of the games? Anthony Kuhn for NPR says that the government’s rules are giving rise to a new Olympic sport: griping.

The new regulations have given rise to some inconveniences for residents of Beijing: job fairs are canceled, the health ministry has asked hospitals to postpone non-essential procedures to free up medical staffs and there’s a ban on remote-controlled airplanes. A rash of bad press about the rules in other countries has led some to dub them the “No Fun Games.”

The tightening rules have some business owners worried. For example, police are getting strict about closing times, and it’s changed the odds for those who were hoping that an influx of visitors would bring in a windfall.

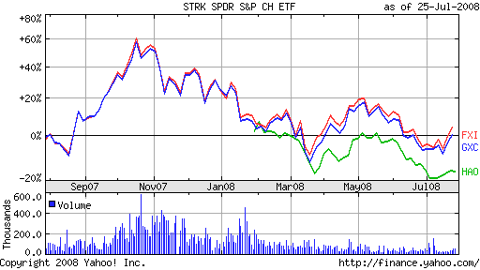

ETFs that could be affected by restriction include:

- iShares FTSE/Xinhua China 25 (FXI), down 18.9% year-to-date

- SPDR S&P China (GXC), down 22.8% year-to-date

- Claymore/AlphaShares China Small Cap (HAO), down 17.8% since Jan. 30 inception

South African ETFs Represent a Mixed Bag

South Africa is showing renewed vigor that’s helping its currency ETF.

The South African rand strengthened against the euro for the second week in a row, showing the country’s strength and endurance in the global market. At the moment, the rand is outperforming high-yielding currencies, and it strengthened against the euro as interest rates neared their highest for the past five years, explains Garth Theunissen for Bloomberg.

The rand also offered the fourth-best carry-trade return against the euro among the 16 most popularly traded counterparts, as watched by Bloomberg. The rand gained 1.3% to 11.8922 per