Bill Gross runs PIMCO's huge flagship bond fund which, having engaged in an untimely shorting of U.S. Treasuries, has hit a bit of a rough patch in recent times. Some have suggested that the 69-year old might be a few years past the recommended portfolio manager retirement age and that it's no longer as useful as it once was to read his monthly investment newsletters.

Think again.

While Gross's timing on shorting U.S. Treasuries has been poor, and his revealing in this month's column of memory issues is a little unnerving, his analysis of the fundamentals and medium to long-term sovereign fiscal picture remains sound.

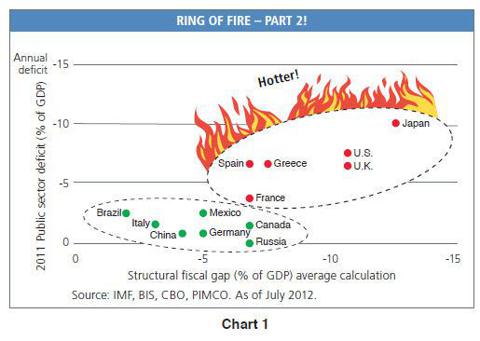

Take his updated "Ring of Fire II" chart, the first version of which he first published a few years back. The chart (below) plots countries by both their annual public sector deficit (y-axis), which is the difference between government spending and taxes, and what is termed a "fiscal gap" (x-axis). The fiscal gap takes into account future expenditures, which in the U.S.'s case include entitlements such as Social Security, Medicare, and Medicaid.

As you can see from the chart Italy appears to be in better fiscal shape than several "Ring of Fire" members like the U.S., Japan and the U.K. How is this possible? Italy has been experiencing what economists refer to as a "speculative attack" from the sovereign bond market, while the three Ring of Fire countries are currently enjoying record low yields on their government debt.

The reason for this seeming paradox is the market currently perceives the risks associated with Italy's inability to print its own currency (due to its membership in the euro) as a bigger short-term credit risk than the unhealthy long-term fiscal position of countries such as the U.S., Japan and the U.K.

This is not