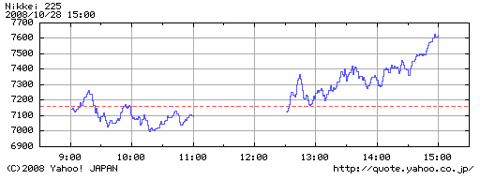

After four days of massive hemorrhaging (over 2,100 points lost), the Nikkei 225 bounced back in an afternoon session rally that gained momentum into the close. The N225 gained 6.4% (459 points) to close at 7,621. In early trading it wasn’t clear a positive close would happen — the N225 fell through 7,000 at one point to 6,884.90 (a 26-year low).

The broader Topix-1 rose 5% to 784, hurt by heavier exposure to banks, non-bank financials and real estate. Nevertheless, the rally had breadth, as 79% of 1st section issues posted gains and 29 of 33 sectors were positive. A weaker yen was also a big help in at least temporarily relieving concerns of recent yen strength although its last trade against the dollar at 95 is still problematic for the “exporters.”

click to enlarge