It appears from pre-market futures that the trading week will open on a down note after Friday's large rally on low volume. I will be using any pullback to add to my income portfolio by adding another 9% yielder in the energy MLP space, Martin Midstream Partners (NASDAQ:MMLP). This entity has sold off more than 10% recently along with other high yielding entities as well as an announcement that it would raise additional funding by pricing new units. MMLP is now offering a nice entry point at $31 a share.

Martin Midstream Partners L.P collects, transports, stores, and markets petroleum products and by-products in the United States Gulf Coast region. The company owns or operates 27 marine shore based terminal facilities and 12 specialty terminal facilities among other assets.

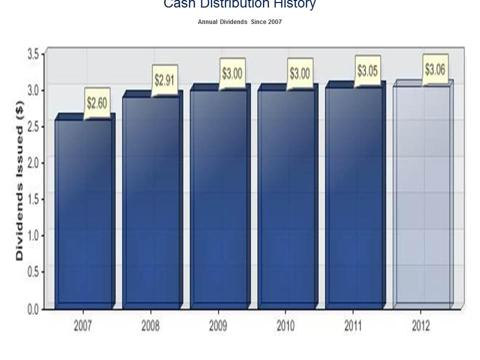

Yield & Distribution Growth:

- MMLP yields a robust 9.8% at current price levels.

- It is one of Dividend Channel's top ten yield investments right now.

- The entity has consistently grown its distribution payouts by a few pennies more a quarter per year over the last decade. Distribution has slowed over the last few years (See Chart). However, given its growth prospects and streamlining efforts (see below), I think these distribution payouts will accelerate in the years ahead.

Valuation, Growth, Catalysts & Analyst Opinion:

- Only three analysts cover MMLP. They all have price targets above the current price and are packed into a tight range (Low Target: $35.50, High Target $36).

- The company is using divestitures to reduce its exposure to natural gas gathering and processing. Martin will be able to focus more on its oil storage, sulfur services and marine transport businesses which will help to streamline the firm.

- Revenue growth is expected to come with a 4% increase in FY2012, but analysts expect that growth will accelerate to 12% in FY2013.