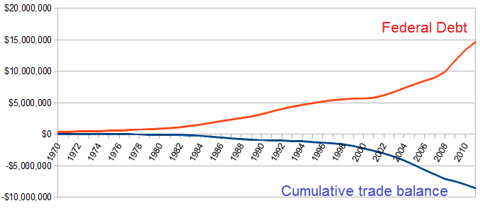

….. the fiscal (government) deficit in the US cannot go away unless we also deal with the trade deficit. As we will see, it is a simple accounting issue, and one based on 400 years of accepted accounting principles. - John Mauldin

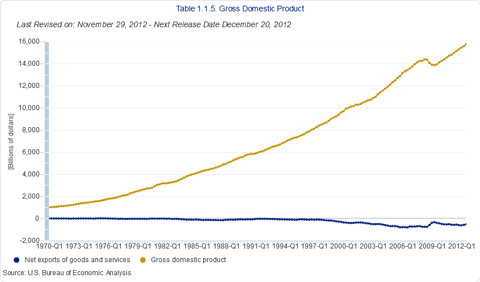

Trade deficit is currently a headwind to GDP. This is as obvious as:

GDP = private consumption + gross investment + government spending + (exports − imports).

In 2011, the trade balance headwind to GDP was more than a 0.5% drag.

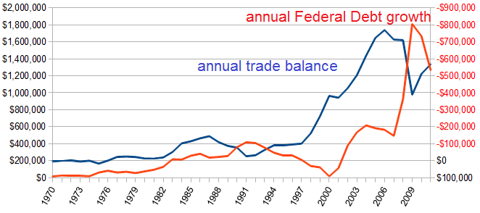

It does appear as if there is some correlation (although far from perfect as you look at the divergence during the 1990s) between the yearly USA Federal debt growth and trade balance.

If one steps further back, the cumulative trade balance deficit and US Federal deficit are growing somewhat at the same pace.

The equation leading to this belief in the association between debt and trade is:

Domestic Private Sector Financial Balance + Governmental Fiscal Balance - the Current Account Balance (or Trade Deficit/Surplus) = 0

This is the central exhibit of Wynne Godley's sectoral balance work of the 1980s and 1990s (for which some think he would have a Nobel Prize had he not passed away too soon). The problem is:

- the world economies are now globalized,

- the USA economy is not the only game in town,

- all these equations treat economies like they live in separate bubbles,

- the dollar itself is the global currency with massive use outside the boundaries of the United States - and this global use is not part of GDP,

- the dollar is a fiat currency - and unlike a backed currency, its dynamics do not need to add up (1 + 1 = 3).

The equation for the trade balance since at least 2000 for the USA is:

Global