Samsung (OTCPK:SSNLF) is taking the global smartphone market by storm.

According to an internal source, Samsung expects to ship 350 million smartphones in 2013. That's a lot of handsets. To put the number in perspective, Apple (AAPL) has sold 269 million iPhones since their 2007 introduction. You'd need to throw in all the iPads ever shipped to get that large a figure.

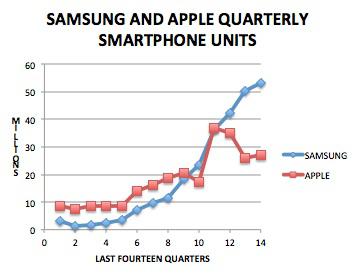

Samsung surpassed Apple in the world's smartphone market earlier this year. Consider the breakout Samsung move seen below:

(Data sourced from IDC)

Argue what you will about Apple and its whopping smartphone profits, Samsung has become the volume leader.

Who benefits from Samsung's success? (Besides, of course, Samsung)

350 million smartphones means 350 million transmitters, 350 million amplifiers, and 350 million receivers. While Samsung manufactures their smartphones and provides the battery, camera and chip, a number of companies supply components and stand to gain from 2013's Galaxy III S sales.

Whose components are inside the Samsung Galaxy III S?

The teardown reveals:

- Intel Wireless PMB9811X Gold Baseband processor

- Broadcom BCM47511 Integrated Monolithic GNSS Receiver

- Wolfson Microelectronics WM1811 stereo codec

- Skyworks SKY77604 Multi-Band Power amplifier

- Silicon Image 9244 low-power MHL Transmitter

- Infineon PMB5712 RF transceiver

Intel (INTC)

For all the talk about Intel's absence from the cellular market, Intel is coming on strong in baseband processors. Reportedly, it has 15% of a $15 billion market. With its Galaxy III S presence, Intel's share will likely increase.

Wolfson Microelectronics (WLFMF.PK)

Cirrus Logic (CRUS) supplies the acoustics for the iPhone. That has made Cirrus a favorite Apple derivative play. What about Wolfson? It's Samsung's go-to supplier for sound. Wolfson's audio hub is in Samsung Galaxy III S and its Note 10.1 tablet. This British $371 million market cap electronics firm bears a look.

Silicon Image (