By John Spence & Tom Lydon

The PowerShares QQQ Trust (QQQ), one of the most actively traded ETFs, has been lagging way behind the market ever since top holding Apple (AAPL) began its sharp pullback after topping out just above $700 a share in September 2012.

The Nasdaq-100 ETF is down 1% the past six months, versus a 7.5% advance for SPDR S&P 500 (SPY). Apple shares are down about 36% from their all-time high set last year.

Apple is still the largest stock in QQQ, which weights its holdings by market cap, at 13% of the portfolio. The ETF is comprised of the 100 largest nonfinancial stocks listed on the Nasdaq Stock Market and is seen as a liquid proxy to trade the tech sector.

Shares of Apple are higher for March and are testing the 50-day simple moving average, which has been a strong resistance line the past several months. If the stock can get back on track, it would provide a boost to QQQ given Apple's large weighting in the ETF.

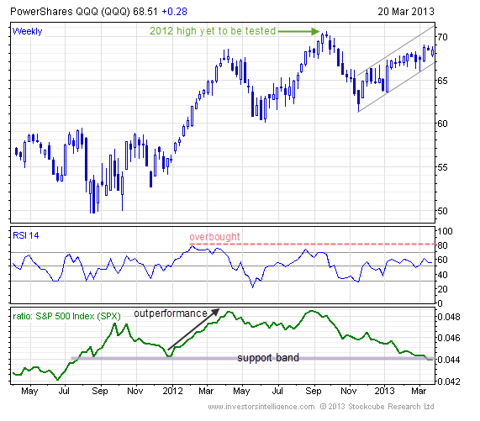

On a positive note, Tarquin Coe, technical analyst at Investors Intelligence, points out the Nasdaq-100 fund has maintained a steady uptrend off its November low.

"We continue to see the fund as a catch-up candidate," he wrote in a newsletter. "The relative chart versus the S&P 500 is well positioned as it trades across a band which provided support in 2011. Turning up would kick off an outperformance run, something which could last weeks."

PowerShares QQQ

Full disclosure: Tom Lydon's clients own QQQ, SPY and AAPL.

Disclosure: I am long AAPL, QQQ, SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.