Nokia's (NOK) Q1 earnings report gives us a chance to look at their smartphone results (which are grouped into Nokia's Smart Devices business unit) and compare the gross margin value of their Lumia sales to BlackBerry's (BBRY) Z10 sales. We aren't going to look at Asha gross margins since BlackBerry doesn't have anything comparable for that target market.

What stood out for me from this analysis and comparison is that Nokia really doesn't make much money when it sells a smartphone, even for one of their newer Windows Phone 8 Lumia models.

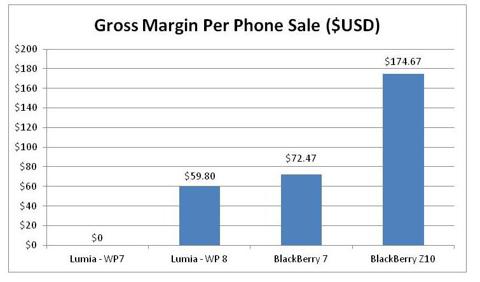

Comparison Between BlackBerry Margins and Nokia Lumia Margins

I've converted Nokia's figures from Euros to USD at a rate of $1.30 per € to make for an easier comparison in the below chart.

The BlackBerry Z10's gross margins appear to be much higher than the gross margins for the Windows Phone 8 Lumias. BlackBerry makes about as much per Z10 as Nokia does for three Windows Phone 8 Lumias. In fact, BlackBerry also still makes 20% more per legacy BlackBerry 7 device than Nokia does for their new Windows Phone 8 Lumias. While Nokia may have needed to clear out inventory by selling their Windows Phone 7 Lumias at cost, BlackBerry is still able to get significant value from BlackBerry 7 customers due to service revenues.

Service revenues make up a much smaller proportion of the Z10's profitability, but it appears that this is made up for by hardware margins that approach Samsung's level.

Now on to the calculations to get to these numbers.

Nokia Smart Device Margins

Nokia said that Lumia sales were 5.6 million units during the latest quarter and Symbian sales were 0.5 million. WP8 sales accounted for approximately 2/3rd of Lumia volumes.

We are going to assume that the WP7 Lumias were sold at