Every earnings reporting season seems to have a life of its own. Let's check out how it looks so far to see if we can detect any trends which might continue now that the season is in full swing.

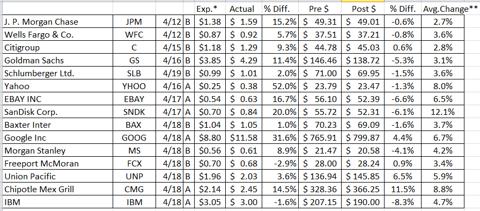

If we assume the earliest possible date a company who reports is on a calendar year basis (which includes most companies), the earliest possible reporting date is April 1, 2013. Since that time, 15 large companies (all of whom have weekly options available and trade for over $20) have announced. Here are the results:

*Expected earnings per analysts, source: TD Ameritrade

**Average post-earnings historical change, source: EarningsWhispers.com

Pre $ = Closing stock price on the day before earnings were announced

Post $ = Closing stock price on Friday after earnings were announced

Thirteen of the 15 companies beat analyst expectations by an average of 14.8%. Only Freeport McMoran (FCX) and IBM (IBM) failed to meet expectations. Even though the great majority of companies exceeded expectations, it generally did not result in higher stock prices after the announcement; in fact, 9 of the 13 companies which beat expectations recorded lower prices after announcing. In total, two-thirds of the companies fell after earnings and only one-third advanced.

Missing estimates was extremely painful for IBM, which fell a whopping 8.3% even though the miss was a negligible 1.6%. FCX fared better, edging up 0.9% in spite of missing by 2.9%.

Two-thirds of the companies fluctuated by a smaller percentage than the average historical percentage (according to EarningsWhisper.com). Most of these events took place last week, when VIX (the popular level of options volatility for the S&P 500 tracking stock, SPY) rose by 24%. In other words, announcing companies fluctuated by far less than they had historically in a week when the general market had unusually high volatility.