In tonight's earnings release, Apple (AAPL) announced a $50 billion increase in its buyback program and raised its dividend by 15%. The buyback alone is massive, and is actually a large enough total that there are only 69 companies in the United States with market caps larger than the buyback.

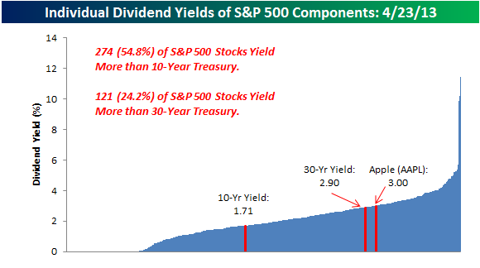

With regard to the dividend, shares of AAPL now yield 3.0% based on Tuesday's closing price. At this level, AAPL now has a higher dividend yield than both 10- and 30-year U.S. Treasuries, which yield 1.71% and 2.90%, respectively. Additionally, the stock also now has a higher dividend payout than 393 of the companies in the S&P 500. This is quite a change from just over a year ago, when the stock had no dividend at all.