The gold industry has been the second-worst performer so far in 2013 (the worst has been the silver industry), the total return year to date (05/10/2013) was negative at -33.7%, while the appreciation of the Russell 3000 index in the same period was at 15.63%. Nevertheless, there are cheap stocks trading way below book value that pay rich dividends among the gold mining companies, and when the gold price rise resumes, a nice capital gain could be expected.

I have searched for gold companies trading below book value that pay rich dividends and that have raised their payouts at a very high rate for the last five years. Companies that regularly increase dividends are generally more reliable. Increasing dividends is the assurance that dividend income retains its purchasing power over time.

I have elaborated a screening method, which shows stock candidates following these lines. Nonetheless, the screening method should only serve as a basis for further research. All the data for this article were taken from Yahoo Finance and finviz.com.

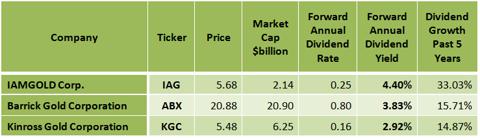

The screen's formula requires all stocks to comply with all of the following demands:

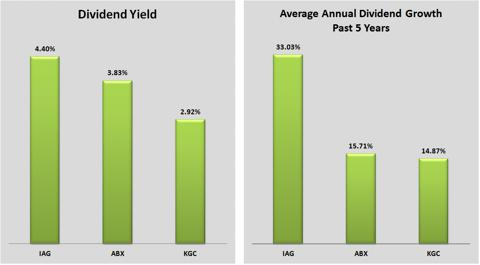

- The dividend yield is greater than 2.90%.

- The dividend yield is greater than the five year average dividend yield.

- The annual rate of dividend growth over the past five years is greater than 14%.

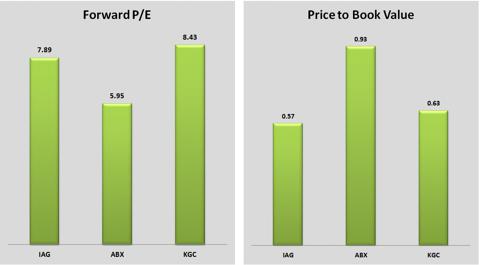

- Forward P/E is less than 9.

- The price to book value is less than 1.0.

After running this screen on May 11, 2013, I discovered the following three stocks:

IAMGOLD Corp. (IAG)

IAMGOLD Corporation engages in the exploration, development, and operation of mining properties. Its products include gold, silver, niobium, and copper deposits.

IAMGOLD has a very low debt (total debt to equity is only 0.17) and it has an extremely low trailing P/E of 6.38 and a very low forward P/E of