Last week we reviewed the white hot Chinese stock market with a cautionary note. I wanted to return to it briefly because the situation is serious and deserving of much more attention.

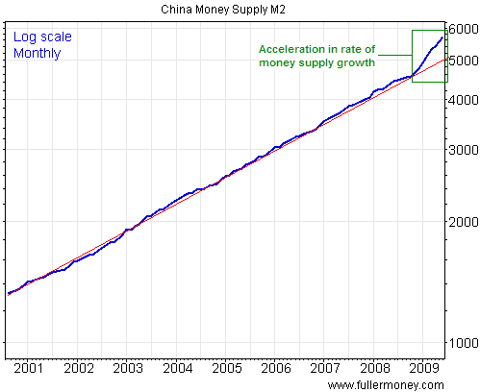

Putting aside price charts of the Chinese equity market for now and turning to monetary measures, we can see something rather alarming happening. China’s M2 has enjoyed a constant rate of acceleration as shown in the chart below (in semi log scale). But in late 2008 the rate of acceleration suddenly increased dramatically:

This was a consequence of the massive stimulus plan put into motion by the Chinese government. They pumped unprecedented amounts of liquidity into their economy to offset the world-wide economic slowdown. There would be nothing singularly alarming about that since all central banks around the world, as well as governments in charge of fiscal policy, have orchestrated a collective burst of activity.

What is alarming is that the Chinese economy, stock market and especially real estate market are just now displaying bubble-like characteristics. The government controlled banking sector is a mystery wrapped in an enigma. No one can begin to fathom the amount of non-performing loans on the books. Unlike the US which went through a gut wrenching cleansing - thanks to the largess of the lobby-less taxpayer, the financial sector is once again back in fighting shape (privatized profits, public losses). China has yet to address their toxic assets

As we briefly touched on before, since last year’s low the Shanghai market has now appreciated more than 100%. Once again the stock market has enthralled the average person in China with thoughts of wealth and the possibility of making more in a month than what they earn in a year at their regular job. Speculation in the market is seen as not only a legitimate