Congratulations, Fed. You tanked stock, bond, and commodity markets all at once. How? Simply by promising to continue your foolish policies into the indefinite future!

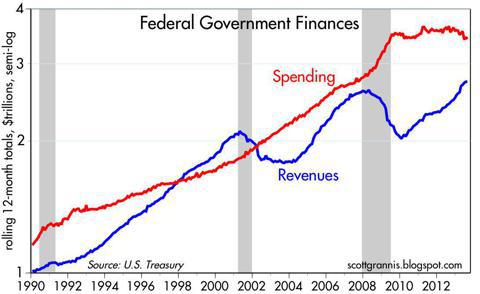

Of course, to deflect the blame, place it on fiscal policy. Revenues pouring into Washington have soared nearly fifty percent since 2010. But I am sure the problem is that horrific decline in spending over the last year or so:

Source: scottgrannis.blogspot.com

Definitely! The government needs to spend more money, quick! Turn on the TV to the House hearings with HHS Secretary Sebelius. Obviously giving her, and other bureaucrats, authority to spend more of our hard earned money is one solution to all of our problems.

In an earlier article, "The Fiscal Cliff...Of 1937", I made it clear that fiscal "stimulus" has never worked, and this was obvious even prior to WWII. 2013 is just another example. Every time we attempt to wean ourselves off of government spending (or lose money) markets swoon like a drug addict denied his latest heroin fix.

Since today's 2 p.m. announcement:

- bond prices have fallen. So the problem is not slow growth, otherwise they would have risen at the prospect of lower rates.

- gold prices have fallen. So there is no crisis or inflation imminent, otherwise they would have risen.

And why did stock prices fall? Could it be that long-term investors and short-term traders alike are "FED" up at how clueless our central bank has become?

I expect stock prices to stabilize as shareholders realize the slow growth of the last few years will continue, perhaps at a slightly higher pace in the next few quarters as lower energy prices pump up consumer disposable income. Once bondholders realize there is no reason for the Fed to continue gobbling up $85 billion worth of Treasury paper each month, Tbonds should continue the