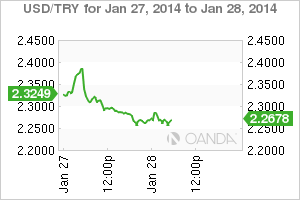

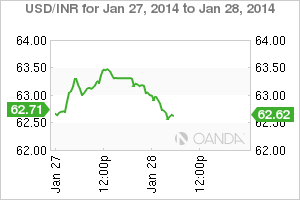

It seems that the emerging markets are not sick enough for the rest of the world to be concerned about just yet. This appears to be the consensus view amongst analysts just as investors consider testing the waters again. Only time will tell if any potential unhinging is limited only to a few unbalanced economies like those of Turkey and Argentina. The developed world is supposedly somewhat immune now that growth is evident, backed by a pliable domestic central bank policy. The investor should be deeply worried if slowdowns and sell-offs deepen in bigger economies – like in China – that manage to "infect the financial markets of industrial nations and deprive them of demand for exports and commodities."

What has transpired so far in 2014 is being considered as a warning shot across the global investors' bow. So long as the emerging markets do not put the US economy particularly at risk, the world is supposedly healthy enough to overcome almost everything. The interrelationship between the developed and developing economies has dramatically shrunk over the past two decades. In the US, the investors' beacon, emerging markets drive 15% of the sales of companies in the S&P 500 Index, with China accounting for a third of that percentage. According to the IMF the growth gap between the two is the smallest in a "baker's dozen years. It's no wonder that when a developing economy catches the sniffles the global investor becomes concerned very quickly.

It's the pliable central bank that has kept the market in tow, from the Fed to the CBRT (Turkey). They are required to be more proactive than in history's past. It's not even odd anymore that a governor is adorned like a "rock star" – in particular, Governor Carney at the BoE, and outgoing Fed Chair Ben Bernanke. Vacating his Fed position, you can be sure that