It’s been a while since I posted my first analysis on Gymboree (GYMB). I’m still long and the company has continued to perform well. The stock had a nice run, but has come back down near the levels where I originally posted my analysis. The purpose of this update is to refresh my financial analysis and, given the recent decline in the shares, evaluate if we are back near a buying opportunity. I won't repeat my entire long thesis, so please refer to the earlier post linked above if you aren't familiar with the company.

Net asset value

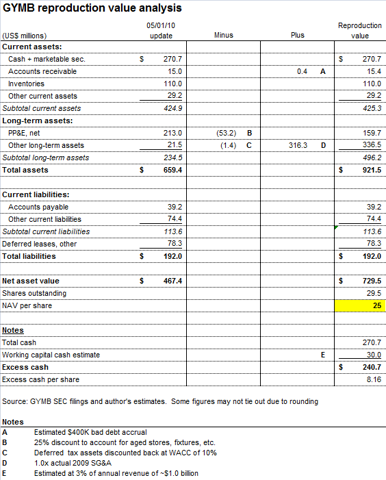

Based on the balance sheet analysis shown below, I peg the reproduction value of Gymboree’s assets at approximately $25 per share as of its 5/1/10 financial update. The most material change from my prior analysis is really just that cash has increased by about $2 per share, supporting the rise in NAV from $23 to $25. (Click to enlarge)

Earnings power value

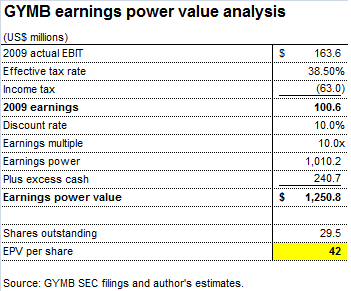

Again, no huge change here – the major variance is still the continued buildup of excess cash on the balance sheet (+$2/share) while the increase in earnings and slight reduction in share count contributed modestly (+$1/share).

Growth value

I’m keeping my assumption of a 6% rate of growth constant. As noted in my previous post, Gymboree has grown its revenue base at a compound annual rate of approximately 8% over the past decade. Revenue held steady during the severe consumer economic decline in 2009, and was up 10% year-over-year for the most recent quarter (+2% same store sales). The company continued to open new Crazy 8 stores at a fast pace, and its very high return on invested capital continues to create substantial additional shareholder value through growth. Using 6% as a conservative estimate of long-term growth, I arrive at a GV of $69 per share. Note again that over $2 per share of this increase in