Author's Note. 8/10/14. GT Advanced Technology, one of the companies in my "Sustainable Energy" portfolio, has filed for bankruptcy protection.

On Dec. 21, 2012, I put $16 million imaginary dollars in equal imaginary investments in 16 real energy companies; $8.0 million in the Sustainable Energy space and $8.0 million in the fossil fuel space. I published my inaugural article on the subject on Popular Logistics, here, my most recent article on Popular Logistics and Seeking Alpha.

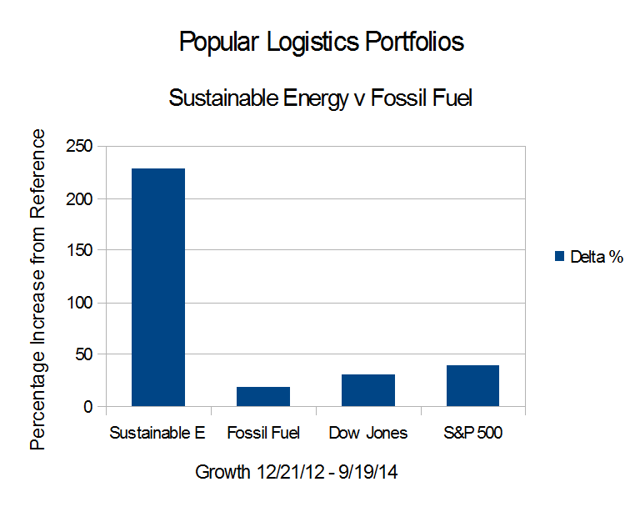

While both portfolios are up from Dec. 2012, and both are down from August, 2014, the Sustainable Energy portfolio is up from $8.0 M to $23.3M, or 191.6%. In the same time frame the Fossil Fuel portfolio us up from $8.0 M to $9.1 M, or 13.5%. The reference indices are also up; the Dow Industrials climbing from 13,091 to 17,280; the S&P 500 climbing from 1,430 to 2,010.

This, to me, indicates a paradigm shift.

The Sustainable Energy portfolio is composed of Cree (CREE) and Lighting Sciences (OTCQB:LSCG) in the LED space, GT Advanced Tech (GTAT), which at the time made solar ovens for cooking PV wafers, and today is diversifying, First Solar (FSLR) and Sunpower Corp. (SPWR) in the solar space, Vestas (OTCPK:VWSYF), a wind company, Solazyme (SZYM) a biofuel company and Next Era Energy (NEE), a utility.

The fossil fuel companies are the oil companies British Petroleum (BP), Chevron Texaco (CVX), Conoco Phillips (COP), Exxon Mobil (XOM) and RD Shell (RDS.A), the coal company Peabody Coal (BTU), and Haliburton (HAL) and Transocean (RIG), companies in the offshore oil and oil and gas drilling service industries.

The data are summarized beginning in Table 1, below.

| Summary Data | ||||

| Portfolio | 12/21/12 | 09/19/14 | Delta | % |

| Sustainable Energy | 8,000,000 | 23,328,433 | 15,328,433 | 191.61% |

| Fossil Fuel | 8,000,000 | 9,081,164 | 1,081,164 | 13.51% |

| DJI | 13,091 | 17,280 | 4,189 | 32.00% |