Given what seems like a parabolic increase in gold and silver prices, many investors are attracted to these metals as investment opportunities. We have a difficult time evaluating whether these metals are overvalued or undervalued. The difficulty arises from the fact these metals do not generate any cash flow. We value investments we make for our client accounts based in large part on the cash flows generated by particular investments. Consequently, at this point in time we do not have a direct allocation to either gold or silver for our client accounts.

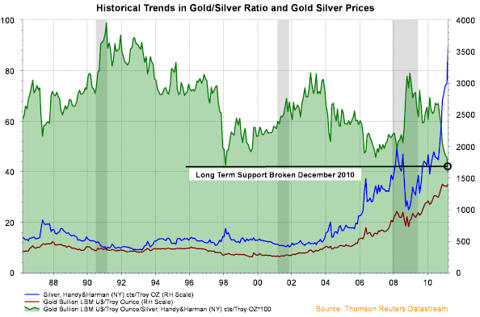

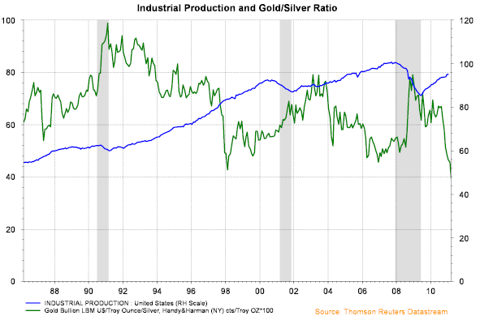

On the other hand, we do evaluate gold and silver prices as they are an important input into our analysis of the future direction of economic growth. Gold tends to be a safe haven investment for investors with events like those occurring in the Middle East impacting the price of gold. During times of improving economic activity though, silver tends to outperform gold due to silver's wider industrial use compared to gold; hence, driving up the price of silver. Since mid-2010 silver has outperformed gold. The first chart below shows gold and silver prices along with the gold/silver ratio. In the second chart, the gold/silver ratio is plotted with U.S. industrial production.

Click charts to enlarge:

| From The Blog of HORAN Capital Advisors |

| From The Blog of HORAN Capital Advisors |

As of March 11, the gold/silver ratio stood at 39.3 and this is below the support level of 43 that has held since February 1998. Additionally, the above chart that includes industrial production shows a declining ratio along with improved industrial production activity. For investors then, if they want to use gold and silver prices as an input in their economic forecast, evaluating the gold/silver ratio can be a useful indicator to track.