After Yahoo (YHOO) released Q314 earnings, most of the financial media outlets reported that the company smashed analyst estimates. The online media company flush with cash from selling Alibaba (BABA) stock at the recent IPO is still struggling with operations despite the headlines. The media latched onto the non-GAAP earnings of $0.52, but seemingly missed that the results were highly influenced by gains in equity interests. The continued decline in the daily operations should garner more focus considering investors were already well aware of the strong numbers from Alibaba.

Not So Impressive Q3 Results

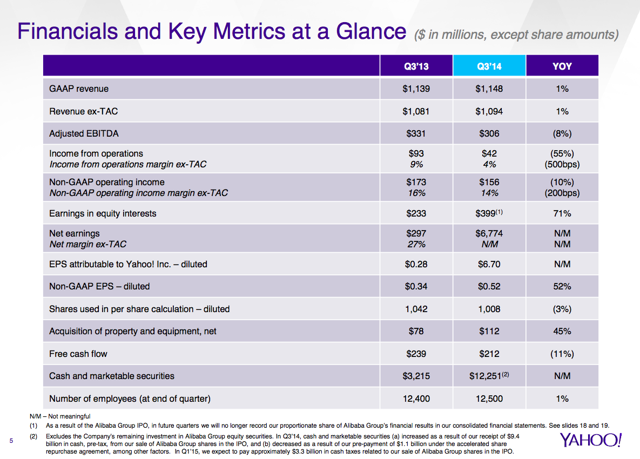

The company reported non-GAAP revenue and earnings that easily beat analysts estimates. Revenue came in at $1.095 billion providing for a slight beat to estimates of $1.050 billion. EPS jumped to $0.52 with estimates sitting at $0.30. While these headline numbers were impressive, the actual numbers from operations were very negative. The only real impressive number was the surge in earnings from equity investments. Without that improvement over last year, the operating income from operations suggested a 10% decline in EPS.

Source: Yahoo Q314 slides

Advertising Trends Unimpressive

While search revenue saw an improvement, display revenue was down again. A 24% surge in display ads sold was met with a likewise 24% decline in the price-per ad. The display numbers continue a trend where the number of ads is inversely related to the price leading to flat to negative growth. In addition, some of the gains in search has been equally met with the down draft in display revenue.

Source: Yahoo Q314 slides

At the end of the day, the combined search and display revenue sat at $846 million in Q314, compared to $847 million last year. The limited revenue growth for Yahoo came entirely from the lackluster $15 million gain in the other revenue column.