Overview

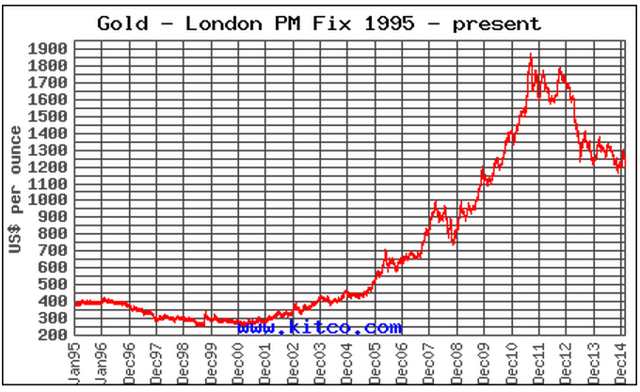

The gold market (GLD) has been one of the best performing in the 21st century, having outperformed broader stock market indexes and several commodities. It hit its low of $255/oz. in the summer of 1999 and it trades at just over $1,200/oz. today for a gain of 375%.

While this certainly looks like a bull market I would argue that we have, in fact, not yet begun to see a bull market in gold from a couple of critical standpoints:

- Valuation: Gold is cheaper today, or as cheap as it was, based on key metrics than it was in 1999.

- Gold's rise has coincided with a fall in yields, which is anathema to a gold bull market.

1--Gold's Valuation

In spite of the substantial rise in the gold price that we've seen over recent years this price increase doesn't reflect the incredible amount of money creation we have seen. There is a reason for this which I will get to later in this article.

Gold's price in Dollars should, over the long term, reflect the Dollar's purchasing power, which is in part correlated to the supply of Dollars. As the supply of Dollars rises it is intuitive that these Dollars should buy fewer goods, ceteris paribus. The idea here is that Dollars are valuable only insofar as they can be exchanged for other goods, and that an increase in their supply should lead to a decline in their relative value.

Meanwhile, while gold has industrial value its primary function is in its exchange value. Gold has a relatively stable supply and it possesses several qualities that make it suitable (not ideal) as a long-term store of value, including scarcity, fungibility and physical stability.

Gold's price increase has not reflected this rise in Dollars unless you use specific measurements