Elevator pitch

On 01/10/2016, the Wall Street Journal reported that Kohl's (NYSE:KSS) is considering going private or breaking up. it is essential to note that the underlying message is not whether or not Kohl's decides to go private or break-up, but the fact that the firm is considering ways to unleash shareholder value. This underlying message is what makes Kohl's a good opportunity.

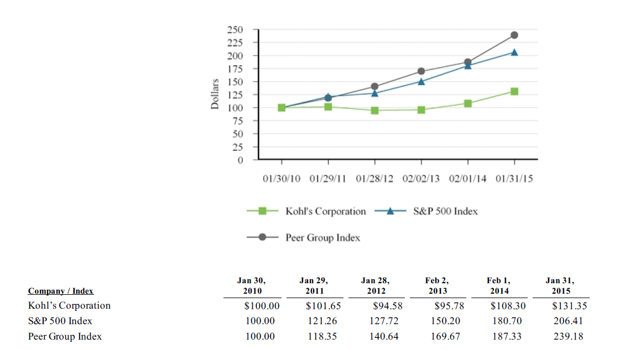

In the last nine months, Kohl's share price has declined by ~40% and its overall performance has been relatively low compared to its peer group and the S&P 500 as shown in Figure 1.

Figure 1: (Kohl's 2015 10K)

Since the financial crisis, Kohl's has made considerable progress to reposition itself for growth, bolster investor confidence through dividends and buybacks and it has invested heavily in e-commerce by leveraging its 1,200 stores to create initiatives such as buy online and pick in-store. Despite these efforts, Kohl's still trades at half its sales and has a P/E ratio which is ~46% below its industry average.

But it could take time for Kohl's to realize its true value as a public company. Its investments in e-commerce, developing efficient distribution channels and expanding margins to historical levels needs time and patience. Patience that the street does not have.

As a result, going private would be an optimal strategy for shareholders to realize low-risk returns quickly. Using precedent transaction analysis, Kohl's is poised to fetch a multiple that could see returns in excess of 50% from its current stock price. Therefore, if pushed through, this will be a good way for investors to realize good returns in a stagnant market.

Why Kohl's has underperformed?

Figure 2: (Nasdaq, Kohl's 1-year Stock Performance)

Since April 2nd of 2015, Kohl's stock price has declined by ~40% in the last 9-months. The reasons for Kohl's underperformance are numerous, some of