GW Pharmaceuticals (GWPH) released Q3 results which were basically in line and set up plans for the future of this leading medical marijuana company.

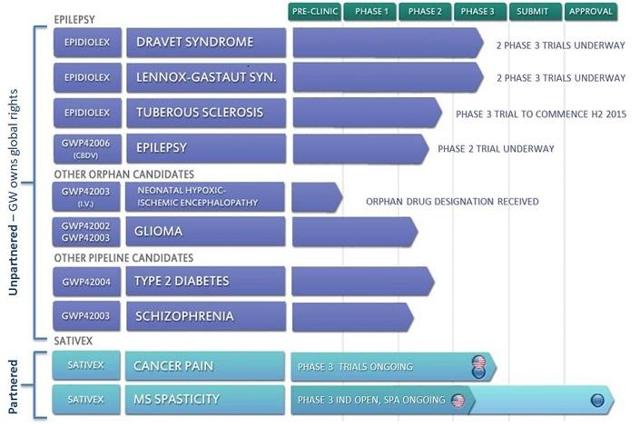

As I pointed out in my previous article, more important for investors is whether the company can continue to have promising results for its drug Epidiolex. These tests currently target four childhood epilepsy conditionsL Dravets Syndrome, Lennox-Gastaut syndrome, tuberous sclerosis ("TSC"), and infantile spasms. Epidiolex is a liquid formulation of pure plant-derived cannabidiol.

Orphan designation has been given by the FDA for these conditions. This allows for a 7-year patent protection and fast-tracking of the testing process. The European Medicines Agency (EMA) has confirmed a similar program.

Testing for a whole range of conditions using different cannabinoid formulae is also starting up. I had detailed some of these in my previous article. A summary of some of these tests from the company website is detailed below.

The earnings release gave some vital up-dates on the above.

Apart from Epidiolex, there is the company's Sativex nasal spray which contains two cannabinoids, THC and CBD. This product is at Phase 3 testing for treatment of cancer pain. It is already sold in 28 countries for the treatment of spasticity caused by multiple sclerosis. Multiple sclerosis affects 1.2 million people worldwide, of whom about 84% suffer from spasticity. So the total world market potential is quite substantial.

At the Q3 earnings announcement the company stated that a further Phase 2 study was under way with the FDA for spasticity due to cerebral palsy. Data from this is expected in Q4. In the quarter under review the value of Sativex sales rose 36% on a year-on-year basis.

Results

The full figures can be seen here.

Earnings estimates by analysts had been quite varied. They ranged from an earnings per share loss