Profitability is a difficult concept to measure, especially with the hundreds of different options on how to evaluate it. One of the most important ways is to evaluate a company's sources of profitability.

This can be done through DuPont analysis of return on equity (ROE) profitability. We ran DuPont on stocks that appear to be highly undervalued stocks, with PEG below 1 and P/FCF below 15.

DuPont analyzes return on equity (ROE, or net income/equity) profitability by breaking ROE up into three components:

ROE

= (Net Profit/Equity)

= (Net profit/Sales)*(Sales/Assets)*(Assets/Equity)

= (Net Profit margin)*(Asset turnover)*(Leverage ratio)

It therefore focuses on companies with the following positive characteristics: Increasing ROE along with,

•Decreasing leverage, (i.e. decreasing Asset/Equity ratio)

•Improving asset use efficiency (i.e. increasing Sales/Assets ratio) and improving net profit margin (i.e. increasing Net Income/Sales ratio)

Companies with all of these characteristics are experiencing increasing profits due to operations and not to increased use of financial leverage.

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the top six stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

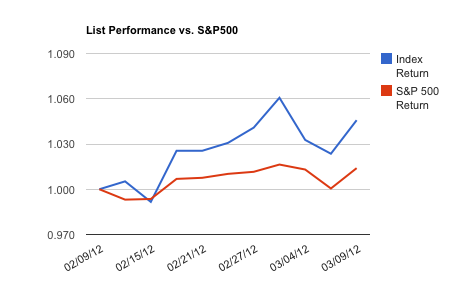

We also created a price-weighted index of the stocks mentioned below, and monitored the performance of the list relative to the S&P 500 index over the last month. To access a complete analysis of this list's recent performance, click here.

Do you think these companies have strong profitability? Use this list as a starting point for your own analysis.

1. Apple Inc. (AAPL): Designs, manufactures and markets personal computers, mobile communication and media devices, and portable digital music players, as well as sells related software, services, peripherals, networking solutions and third-party digital content and applications worldwide. PEG at 0.83. P/FCF at 13.49. MRQ net profit margin at 28.2% vs. 22.45% y/y. MRQ sales/assets at 0.334 vs. 0.308 y/y. MRQ assets/equity at 1.54 vs. 1.587 y/y.