We published a full, comprehensive research report in which we analyzed and evaluated Teva Pharmaceuticals Industries (NYSE:TEVA) and we concluded that it is absolutely ridiculous that Teva should be trading at an adjusted 2012 PE of 7.5X earnings and a reported PE of 11X trailing earnings. Despite its stumbles under the previous CEO, Teva is still the industry leader in the generic drug segment. Despite the stumbles, we believe it offers a superior risk-reward scenario versus its competitors in the generic pharmaceutical space.

Because we added to our long position in the company in June, we have decided to expand on our previous research, analysis and evaluation of TEVA versus its peers and we are going to compare it to four of the biggest major pharmaceutical firms that focus on cutting-edge innovative blockbuster drugs. The four competitors we are comparing TEVA against include Johnson & Johnson (JNJ), Merck (MRK), Pfizer (PFE) and Bristol-Myers Squibb (BMY). As everyone knows, BMY was the former employer of Teva's new CEO Dr. Jeremy Levin.

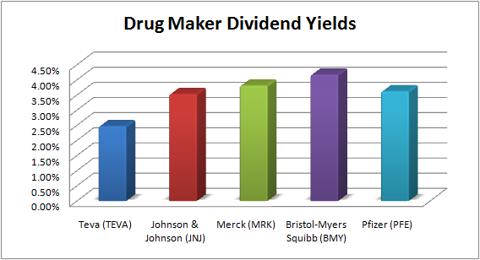

The first metric we are going to compare TEVA against JNJ, MRK, BMY and PFE is the dividend yield. We can see that while TEVA has a decent dividend yield of nearly 2.5%, it is much smaller than that of its competitors. Teva's competitors had a median Dividend Yield of 3.72%, which is nearly 50% higher than TEVA's dividend yield. We believe that this is due to the fact that TEVA has a smaller dividend yield than its competitors because TEVA has been a historically smaller firm than the Big Four Big Pharma firms. Also Teva has a much lower payout ratio than its competition because the competition is at a more mature stage and has found less profitable capital investment opportunities for its free cash flows.