Japan is still hanging on it seems, but for how long? This is what I will try to clarify in this entry. In the following I will thus continue my ongoing analysis on two months' worth of data as well as loads of timely analysis from other sources where, as usual, Ken Worsley and Takehiro Sato/Feldman from Morgan Stanley have my complete attention. In accordance with tradition four overall themes will form the backbone of the analysis; trends in prices, domestic demand figures, industrial output/exports, and finally the JPY which as ever is the subject of much attention in currency markets and beyond.

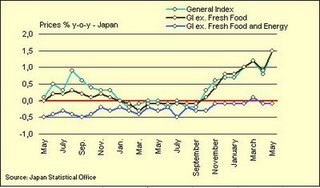

When it comes to prices it could seem as if Japan's quick return to inflation in the core-of-core index was nothing more than a blip. As can consequently be observed from the graph below Japan is once again stuck in deflation measured by the core index stripped of energy and food input; both April and May thus saw a decline in US style core prices of -0.1%.

click to enlarge

The graph above also recounts the story of global stagflation with Japan as perspective. Thus, while core-of-core inflation remains in deflation the core general inflation index has shot up on the back of global headline inflation pressures. As will be described below this is obviously having a non-negliable effect on an already lackluster Japanese consumer. More generally, I have been emphasizing this chasm between core and headline inflation for quite some time as well as I have been pointing out that inflation in Japan was solely of a cost-push nature rather than demand-pull.

Indeed, the whole discussion of "spill-over effects" in Japan and how activity in one part of the economy (corporate capex/exports) would automatically lead to an increase in domestic demand seems now to have finally been laid to rest. This