My SHB Cycle ! - ( a short explanation )

Initially written: 03/1987 and Updated: 10/25/10

This is my 2th Article in a series I call: "Why Most Investors and Nearly All Traders Lose Money." It is also expanded in one of the chapters I have in my (un-published) book. The title of my book is: Decoding Wall Street.

By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another's, and each obeying its own law... The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint. -- Mark Twain.

It is one of the Three Pillars of my Methodology of "Investing Wisely". (for and over-view of my Methodology - please see my Personal / Private Blog)

https://twitter.com/#!/InvestRotation

Brief Introduction:

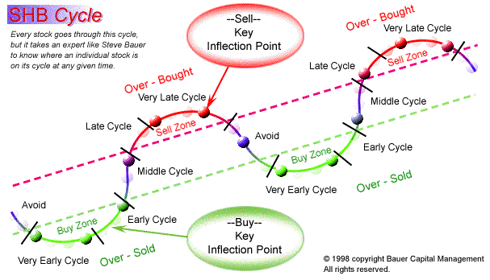

A definition of Cycle Analysis: It is a form of technical analysis involving the process of making investment decisions based on the different stages all Indices and Securities go through over time. These 'stages' are clearly defined on the below chart. Therefore the type (bullish or bearish) investment position taken will depend on the specific characteristics of those individual Indices and Securities at a given time.

My SHB Cycle:

Knowing for sure -- where you / we are on My SHB Cycle (that is the - General Market, Sectors, Industry Groups and all their Components), for the Short and Intermediate-Term - Bull Markets (Buying) -- and -- Knowing for sure -- where they are on the - SHB Cycle -- for the Short and Intermediate-Term - Bear Markets (Shorting) --- is an essential and vital key to your bottom line.

For example: Taking bullish positions when the security is over-valued, over- bought, hyper-bullish is historically viewed as very hostile to successful investing - by the best (world class financial analysts) in the business. It is just saying "I want to be restricted on the prospect for profit." Saying it another way - taking positions when the security is in the late, very late or avoid stage of the SHB Cycle is just saying "This security will defy all the known laws of sound investment management." Those two quotes should get your attention and if not you are in a world of trouble! Obviously the opposite is true if you are taking bearish positions.

Trying to communicate the complexities and nuances of this important Pillar of my analytics is, I'm sure impossible - I have tried many times. This is one more of many drafts and I still do not think I am doing you justice for your understanding of my SHB Cycle. I apologize!

The SHB Cycle is linked to the mathematics of the development of an Inflection Point. The animated version of my SHB Cycle is in my personal / private blog helps to understand that it is both a teaching tool for you and a unique way to look at the technical analysis needed to "Invest Wisely."

All securities go through these cycles at one time or another. And it is important to understand that whether it be a current security you are thinking of buying or shorting - it is somewhere on my SHB Cycle. It is a short-term, intermediate-term and long-term (both individually and combined) representation of the "cycles" of the stock market that repeat themselves over and over and over again.

These cycles are interlaced which can mean that there is a primary, secondary, third, forth cycle, etc., for all securities, which are superimposed upon each other. I want to say this twice: "It's very complex." Because this is or becomes so complex, I created my Rotation Model to smooth it out just a bit. The Rotation Model is able to sort out many of these complexities and give me a much shorter list of candidates for investment. That means that my 'analytics' work load is shortened - not so many securities to review at or near Inflection Poinits. Very few securities are in phase with both the SHB Cycle and Rotation Model. And that fact is a very big plus when going through my analytics process.

I suppose that mathematically this could all be calculated and put into a computer but I am no longer smart enough. I do believe that the major investment firms and banks that are guilty of trading the marketplace on a short-term basis have such a computer-assisted methodology.

When an Inflection Point is reached, my SHB - Cycle is not all that efficient, thus I have created a proprietary checklist I call "Conformations". Conformations, in my commentaries most often are verbally tied to my Inflection Points. I mention above and illustrate in my below chart that the two are definitely inter-related.

- - -

This Chart -- is the Foundation to Knowing for Sure - Where we are on the Cycle of all Indices and Securities and and hence - "Invwesting Wisely."

SHB Cycle - Explained (More Simple than the above - I Think! )

My SHB - Cycle is designed as a teaching tool to help explain My Methodology of "Investing Wisely" in ALL SECURITIES. Be it Apple, Crude Oil, Gold / Silver or an ETF, this wonderful Tool - My SHB - Cycle continues to repeat it's effectiveness in producing profits year after year.

For an Animated Version - Please go to my Blog and click on the Chart and watch the bubbles/dots (Security Prices) move through their Cycle. Visualize a favorite Company or Investment that you follow and you find that they match - very well.

Rallies and Pull-Backs ! -- That's what it is all about.

Within my Methodology there are several tiers / cycles of each -- Rallies for Buying and Pull-Backs for Shorting. Primary, Secondary -- third / fourth level tiers (Cycles) and so on. There is not enough profit potential in third / fourth or more - level tiers (Cycles) so - I use them as a technical set-up (part of my Conformation Process) to identify Buying and Shorting -- Primary and Secondary Cycle / Investment Opportunities. Historically -- Primary Cycles occur (Bull & Bear) 3 - 5 times per year. Historically Secondary Cycles, which include the Primary Cycles, occur (Bull & Bear) 5 - 7 times per year. That means you got to stay alert and do your homework.

- - -

This is serious stuff -- exclusively for you folks that are Serious Investors and are truly interested in making money in the Stock Market . . .

For Me and perhaps For You, The Good News - - Is . . .

I have figured out how to make money despite the endless flow of Washington's way of running the Economy, Wall Street, and the Country. ( this statement is at least, in part true for all governments. I do this without insidiously taking away your money like ( Wall Street and Mutual Funds - DO/DOES ! ). It's the uninformed Investor and the little people that are being hurt by these powerful machines, often called a Democracy. That is suppose to mean - "for the people."

In addition you will find that My Methodology is profitable in both Bull and Bear Market environments.

Keep Smiling, have Fun - "Investing Wisely",

Steven H. Bauer, Ph.D.