Latest News, Articles and Presentations...

Dr. Ed Buiel, Axion's CTO until the end of 2010 -- A link to an archive of his comments on yadoodle about the PbC battery and much more. Invaluable commentary! Thanks to 481086 for putting the list together.

Axion Power PbC Batteries Continue To Demonstrate Effectiveness For Railroad Applications -- Axion completed shipping its high-performance PbC batteries to Norfolk Southern Corp. (NS), one of North America's leading transportation providers, for use in Norfolk Southern's first all electric locomotive - the NS-999.

Axion Power Residential Energy Storage HUB Certified to UL, CSA Standards -- Axion receives UL certification and CSA Standards for their Residential Energy Storage HUB.

"ePower's Series Hybrid Electric Drive - Unmatched Fuel Economy for Heavy Trucks" -- by John Petersen. Discusses the potential fuel savings for ePower's Hybrid electric drive for class 8 trucks using Axion's PbC batteries.

"Axion Power - A Battery Manufacturer Charging Forward" -- by John Petersen. This is an excellent summation on Axion Power's history. It is a good starting point for introducing Axion Power to friends and family.

13th European Lead Battery Conference, ELBC -- Sliderocket of John Petersen's presentation at the ELBC.

Dr. Ender's Dickinson's Presentation on Axion's PbC -- Link to his slideshow at the 13th ELBC.

Axion Power's 3rd Quarter Report and Press Release -- Seeking Alpha also published the transcript of the conference call here.

RoseWater Joins Queen's University on Energy Storage Study -- Testing will determine the effects of residential energy storage systems on local power grids.

---------------------------------------------------------------------------

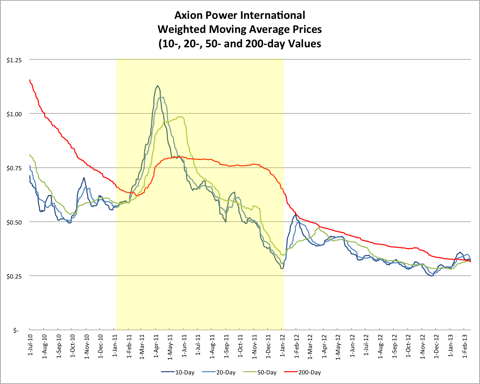

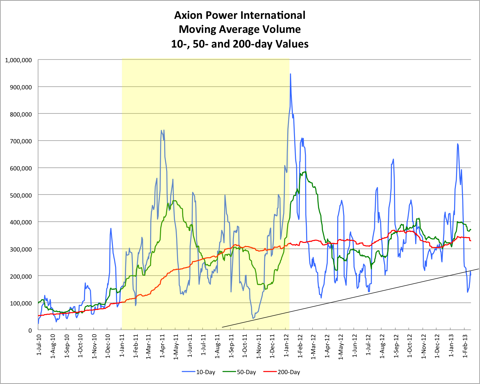

Axion Power Weighted Moving Average Prices and Volume:

(updated thru 02/9/2013)

The 50-day VWMA has moved up through the 200-day.

---------------------------------------------------------------------------

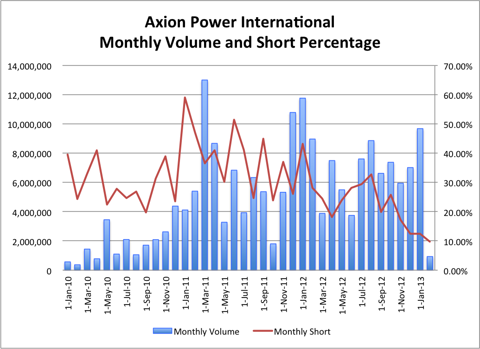

Axion Power Monthly Volume versus FINRA Short Percentage:

In late January I wrote an Instablog about the precipitous decline in reported FINRA short sales as a percentage of total trading volume. Over the last two weeks that trend has accelerated and the percentages for the month of February and the last four weeks are solidly in single digits. I view this graph as another confirmation of seller exhaustion. The big uglies are history and it looks like everybody who really wanted to sell already has.

John Petersen's instablog here.

---------------------------------------------------------------------------

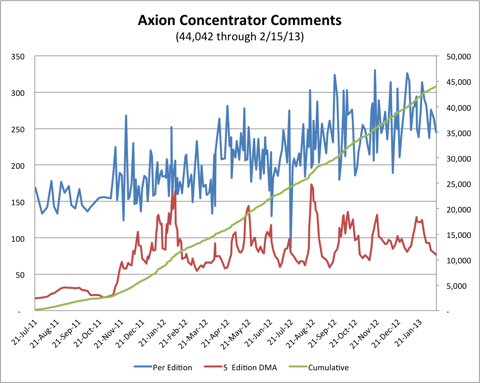

Axion Power Concentrator Comments:

---------------------------------------------------------------------------

Links to important Axion Power research and websites:

The Axion Power Concentrator Web Sites, created by APC commentator Bangwhiz. It is a complete easy-to-use online archive of all the information contained in the entire Axion Power Concentrator series from day one, including reports, articles, comments and posted links.

Axion Power Wikispaces Web Site, created by APC commentator WDD. It is an excellent ongoing notebook aggregation of Axion Power facts.

Axion Power Website. The first place any prospective investor should go and thoroughly explore with all SEC filings and investor presentations as well as past and present Press Releases.

Axion Power Intra-day Statistics: HTL tracks and charts AXPW's intra-day statistics.

--------------------------------------------------------------------

Be sure and either follow the Axion Power Host ID on Seeking Alpha or click the check-box labeled "track new comments on this article" just ahead of the comments section!

--------------------------------------------------------------------

WARNING: This is a troll free zone. We reserve the right to eliminate posts, or posters that are disruptive.

Enjoy!

Disclosure: I am long AXPW.OB.