previous model indication: bearish on the S&P 500 starting 2009-08-17

current model indication: bullish on the S&P 500 as of 2009-08-21

last week was one of the shortest bearish calls i can remember since apr-2009. the only day down was monday which precipitated the bearish signal but then the remainder of the week was - buy, buy, buy! the charts below depict the state of the geodesic as of EOD friday.

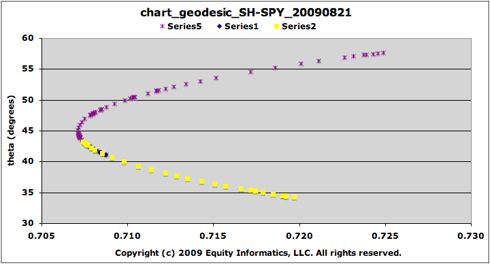

the geodesic parameter coordinates plotted above in yellow are where the market has been in the last few weeks. since the bearish call last week was so short i decided not to introduce a new color series of plotted data to indicate the 4 day bearish sentiment change.

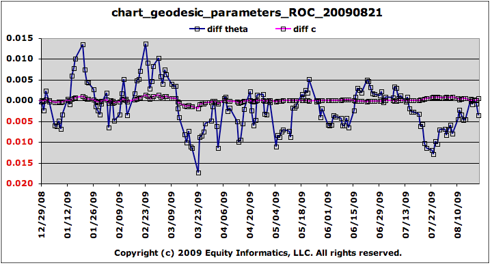

as briefly alluded to above, the angular velocity curve (blue) and the arc-length velocity (magenta) along the path of the geodesic have had a tendency at times to cross each other on a somewhat frequent basis, in particular during a 2 month period after the march-2009 lows. the critical data used in the computation of these velocities are based on 12-day simple moving averages. lengthening the moving average length of time in the analysis would certainly have an effect to reduce the noise. the results of such an investagation may be presented as a future article. not only would the paramter velocities change but the geodesic will as well. infact there would be a family of geodesics to study from.

note how the angular velocity parameter (blue) pulled back all the way to right, relieving pressure from going to the downside. today's (8-24-2009) action, though not down to the extent as last monday, was a bit ominous. at one point the S&P 500 was up 1% or so and then a midday selloff took the index right back to unchanged for the day. no matter how small, midday reversals are not helpful to the bullish mentality. the fed's purchase of treasuries may have had the biggest influence on equities today. in addition, as the market has been going up, investors are trying to stop along the way to buy protection in the form of bonds & put options.

disclosure: in my pairs trade i am weighted 95% spy & 5% sh. this is couterweighted with an accululating position in TLT, TLO TLH, IEF, IEI, BIV, BND & TIP.