OK, so I chose the title to stir controversy... so shoot me!

Obviously we are and have been in a bull market, but my point is that the signs of its impending end are too many (and growing) to allow me more than a small, very cautious short-term long position. Kirk Spano tells a great tale about this from a macro-economic standpoint, but I'm just a simple guy, so I'm focusing on the basics: momentum and volume support.

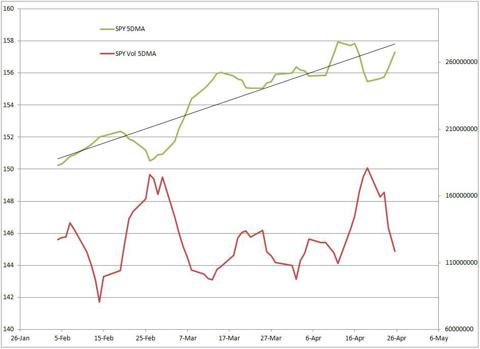

Take a look at this chart of SPY compared to its volume since early February. The uptrend is obvious (as the linear regression shows) but equally obvious is the fact that volume consistently increases on pullbacks and dries up on advances. Not so bullish, long-term.

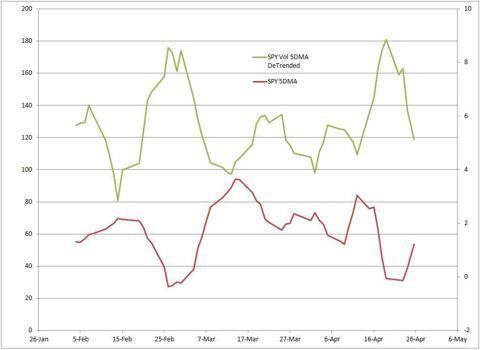

Now look at the same data with the trend removed from the price line. The disconnect between direction and volume is not only clear, it's astounding. That's a correlation of -.78 between price movement and its volume support!

Finally, note the clear and continuing divergence between the uptrend of price and the 14 day RSI. This rally has been steadily losing steam since right after the holidays.

Now, I don't know what the market is going to do (and neither do you, admit it), but for me to get excited about the 'upside potential' right now, I'd need to see the volume curve turning upside down (or going back to right side up, if you prefer) and a decisive break above the downsloping momentum trend. Barring that, I'm going to remain ready for 'The Running of The Bulls', and I don't intend on getting gored!

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.