The 4-hour time frame of USD/JPY shows that the uptrend is still very much intact, despite the selloff we saw on Friday. As it turns out, Japan's Finance Minister gave some comments downplaying yen weakness but these were only politically-motivated prior to the weekend's G20 meetings.

Earlier today, a former BOJ Governor remarked that the central bank could do more to curb yen strength and ward off deflation for the year. This sets the stage for this week's BOJ monetary policy statement, which could contain more clues on what the central bank plans to do in order to meet their inflation targets.

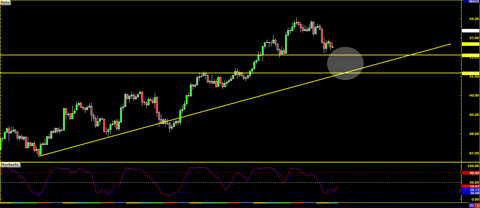

A potential retracement could take place for USD/JPY as the pair looks ready to resume its uptrend prior to the actual BOJ statement. The chart shows potential retracement zones depending on how strong the selloff will be.

Stochastic is in the oversold zone, suggesting a potential bounce is ready to take place. In fact, the oscillator made a bullish divergence as it made lower lows while the price had higher lows.

The pair could find support at the 92.00 area which has held as support last week or it can pull back as low as the 91.00 major psychological level which is in line with the trend line and is a former resistance zone.

Once the uptrend resumes, the pair could rally back up to test its former highs around 93.00 or even break beyond that level and reach the 94.00 mark, depending on whether comments against yen weakness come out or not. Traders could start pricing in their expectations for the upcoming BOJ statement as well, which is projected to contain plans on how the central bank will keep deflation at bay.