After doubling in two years, PetSmart (PETM) has been range bound between $64-$72. This pet specialty retailer looks ready to roll over and play dead.

The company is trading at valuations that are greater than its 5-year historical PE, P/B, P/S, and P/CF averages. At a pricey 21 P/E, it's poised for a correction.

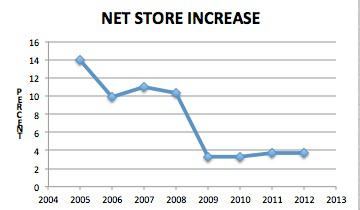

PetSmart's high-growth days are behind it. The company is no longer putting up lots of new stores as its market is becoming saturated. Last year, PetSmart added 46 stores to a 1232 base, a 3.7% increase. Gone are the heady days when the company grew its store count by 14% (2005).

(Sourced from 10ks)

Instead, PetSmart is relying on boosting its margins to deliver earnings growth. That's been successful so far. However, it's hard to improve on a 9.2% operating margin. Very few brick-and-mortar retailers top that.

PetSmart's margins are unlikely to keep climbing. In fact, they might start to decline for the following reasons.

- The payroll tax has reverted back to 6.2% leaving less money in the pocket. That should help drive more customers back to the less expensive grocery store, Wal-Mart (WMT), Target (TGT), feed stores, Sam's and Costco (COST), and on-line shopping.

There's nothing unique about PetSmart. Walk into any Petco, a private chain selling pet products. Petco looks identical to PetSmart - same merchandise, dog grooming and training. Petco has a similar store count and its stores are in the same zip codes as PetSmart.

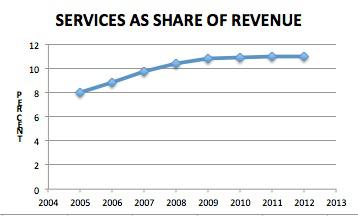

PetSmart's higher margin service business doesn't have as much room to run. The chart below shows the gradual deceleration in service growth. Services as a share of revenue have topped out.

(Sourced from 10Ks)

4. PetSmart is over-staffed. PetSmart has over 23,000 full-time and 27,000 part-time employees. The company has 1278 stores. That's an average