Leading indicators with strong correlations and huge lead times suggest the trade weighted value of the dollar will drop, reversing the counter trend move up that began in the fall of 2011. The bigger downtrend that began in March 2002 should resume soon.

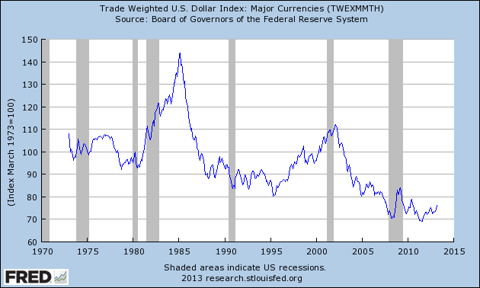

Here is the index we are talking about:

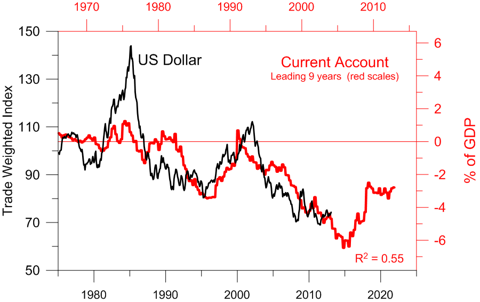

The current account, which is the broadest measure of the trade deficit, has a significant leading correlation with the dollar. When Americans run a trade deficit, i.e. consume more than they produce, it eventually weakens the dollar.

American over consumption reached its height with a current account deficit of 6.5% of GDP in the last quarter of 2005. The chart suggests this would have its maximum downward impact on the dollar at the end of 2014.

The trade deficit is a problem in its own right. Warren Buffett compares America running a trade deficit to a wealthy farm family living beyond its means. They sell a few acres here and there to fund the lavish lifestyle, eventually exchanging the life of wealthy land owner for that of tenant farmer.

When trade flows one way, ownership of assets flows the other. To finance our over consumption since 1983, Americans sold almost $7 trillion of U.S. assets to foreigners. This is a net figure over and above whatever increase in foreign assets Americans own abroad.

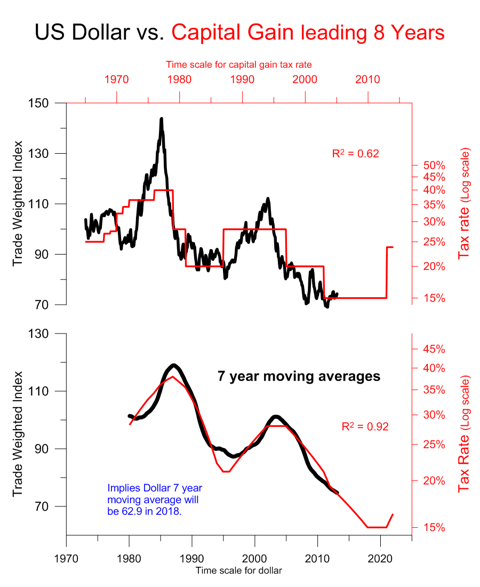

A bit more surprising, but with an even stronger correlation is the influence of the capital gains tax rate on the dollar. Low rates seem to mean a weak dollar.

Conventional wisdom holds that a low capital gains rate encourages growth and investment and should theoretically strengthen the dollar. Reality appears to be different, where a low capital gains rate encourages consumption and financial investment at the expense of real investment in productive capacity. It could be said a