I bought Seagate Technology (NASDAQ:STX) back in June 2012 while the stock was trading around $23. At that time, it was clear to me that STX was a great bargain. The company was showing many positive aspects:

#1 An aggressive dividend increase strategy paired with a low payout ratio.

#2 A Massive repurchase program ($2.5B) fueled by a low price earnings ratio.

#3 The stock had dropped severely after its dividend cut in 2009 and had clearly solved its problem three years later.

For two years in a row, I selected STX to be part of the best dividend stocks for the year. I was very enthusiastic when I bought the stock and had clearly made the right choice back then. But after looking at their latest financial results from May 1st, I'm starting to wonder if it's not time to cash out my profits and run. If I wasn't sitting on a comfortable paper profit, I don't think I would buy more shares right now.

Is STX the Perfect Value Trap?

I read similar comments around the web saying Seagate Technology was the perfect value trap: low P/E ratio, good dividend yield and cash to back it up. While several dividend stocks are trading with P/E ratios over 15, STX is still under the bar of 7. This sounds like the perfect bargain. Think twice: the problem is that sales might not keep up.

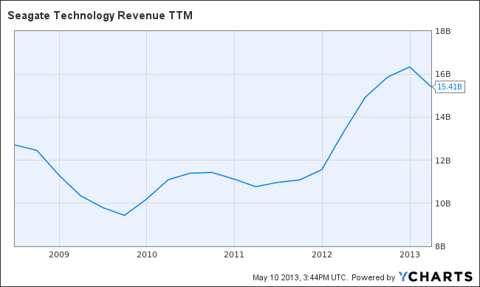

After a surge in sales during 2012, we now see the first sign of weakness with this first quarter (see chart).

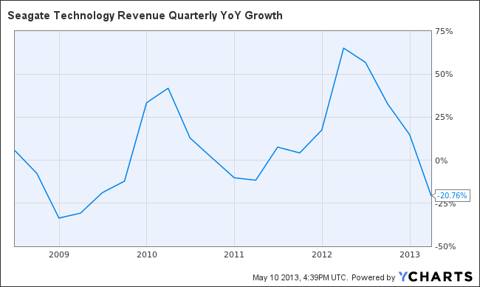

The above chart is not too bad as the sales could bounce back the next quarter. What worries me is the Year-on-Year sales growth trend:

Seagate not only saw its sales head downhill as the PC business is slowing, it is giving away market share