The unit price of Enterprise Products Partners (NYSE:EPD) has risen by 72% over the past 3 years, notably outperforming a return of 44% for the S&P 500 Index. In my view, there remains ample room for further price appreciation owing to the MLP's inexpensive valuation and future catalysts.

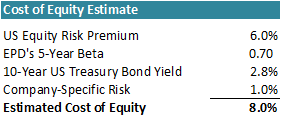

Before going into a qualitative discussion, let's evaluate EPD's current valuation. Based on the CAPM model, an 8.0% cost of equity should be warranted given the following assumptions (note that a 1% alpha was added to account for company-specific in order to be conservative):

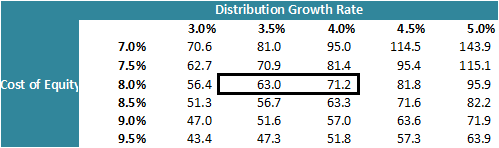

According to Gordon growth distribution discount model, the current unit price of $67.81 implies the following mix of distribution growth rate and cost of equity corresponding to various unit prices:

As such, at 8.0% cost of equity, the implied perpetual distribution growth rate that is currently baked in the unit price is between 3.5% and 4.0%, which is somewhat conservative in my opinion given that EPD's distribution per share has grown by 8.0% CAGR since 2000.

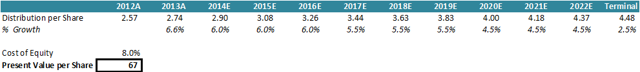

Based on a more realistic 3-stage distribution growth model, a similar conclusion can be drawn. Assuming the distribution per share to grow annually by 6.0% from 2014 to 2016, 5.5% from 2017 to 2019, 4.5% from 2020 to 2022, and 2.5% in terminal year, the present value of all these future distributions per share would be ~$67 at 8.0% cost of equity, which is consistent with the current unit price (see chart below).

Again, I believe the model assumptions used to derive the current unit price to be conservative, meaning that the unit price would rise in the future if EPD is able to deliver higher distribution growth. I believe this scenario is highly likely based on the following reasons:

- In the past 10 years, EPD managed to maintain a stable distribution growth