Cheap, cheaper, Ford Motor (NYSE:F). That is how one could sum up the extraordinary mispricing that the market currently presents in the auto sector. Ford Motor is clearly my favorite in the large-cap car manufacturing sector, and its recent underperformance -- which I think is totally unwarranted -- only makes an investment in Ford Motor more attractive.

Car manufacturers are among the cheapest companies in the stock market right now (based on Price/Earnings valuations) with many firms trading at truly depressed multiples. Auto manufacturers are even cheaper than a lot of basic materials companies, which suffer from cyclically, low commodity demand and depressed valuations as well. As such, car manufacturers such as Ford Motor, General Motors (GM) and Toyota Motor (TM) offer compelling risk/reward ratios, strong upside potential and a great margin of safety.

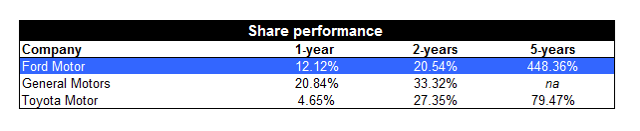

Share performance

From a share performance perspective, Ford Motor has fallen behind lately. The company proved to be quite resilient throughout the financial crisis, and shareholders rewarded Ford Motor for a competitive product portfolio, solid US market share, emerging market success and strong financial performance. The table below shows Ford Motor's share price performance for different performance measurement periods compared to its peers:

(Source: Achilles Research, Yahoo Finance)

Most notably, Ford Motor hugely outperformed over a five-year period. Its return: 448%.

However, most recently, auto manufacturers including Ford Motor came a bit under pressure. Ford Motor has declined more than 16% since it marked a 52-week High at $18.02, offering long-term investors an attractive entry point.

Auto manufacturers started to consolidate at the beginning of the year as increased volatility and uncertainty prompted investors to take profits. I think that declining valuations in the car sector offer opportunistic investors the chance to snatch up a leading car manufacturer such as Ford Motor at a