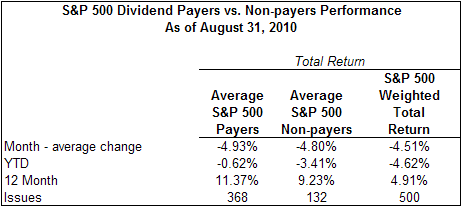

Although the month of August saw the average return for the dividend payers in the S&P 500 Index trail the non-payers and the S&P 500 Index as a whole, on a YTD and 12-month basis, the payers continue to outperform. On a year to date basis, the average return of the payers equals -.62% versus -3.41% for the non payers. On an average return basis, the payers and non payers are outperforming the market cap weighted S&P 500 Index. The fact that the equal weighted returns are outperforming the market cap weighted returns continues to support the findings in the July 2010 report issued by Standard and Poor's. ()

|

| From The Blog of HORAN Capital Advisors |

Source: Standard & Poor's