Delta (DAL) CEO Richard Anderson 'shocked' Boeing (NYSE:BA) investors claiming that it could obtain used Boeing 777-200ERs from Boeing for a price of $7.7 mln. This of course put some pressure on Boeing's share prices as more and more Boeing 777s will come off lease in the coming years and this could seriously impact Boeing's order inflow for the Boeing 777. It is not the first time Delta is not favoring new Boeing aircraft, in 2014 Delta favored Airbus' (OTCPK:EADSF) bid replacement of the older wide bodies over Boeing's.

In this article, I will have a look at how the Boeing 777-200ER compares to the Boeing 787-10 Dreamliner, which could be used as a Boeing 777-200ER replacement.

As the comparison is quite extensive, I will split it in a few parts:

- Ownership costs

- Costs for maintenance, crew and navigation

- Fuel costs

Value

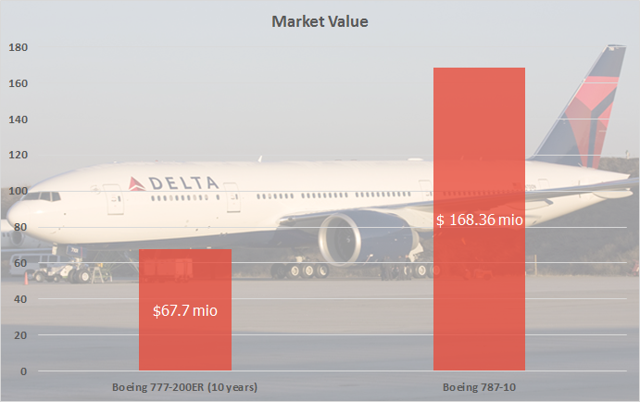

Figure 1: Comparison market value second-hand Boeing 777-200ER and Boeing 787-10 (Source:www.AeroAnalysis.net)

What is clear is that $7.7 mln for a 10-year-old Boeing 777-200ER is reasonable. Fitting a modern cabin into this 10-year-old aircraft might add another $20 mln in costs. Additional costs include a D-Check; costs are assumed to be $3.5 mln and fitting 2 new turbofans on the aircraft costing $20 mln each. Assuming that no other major replacements are required the Boeing 777-200ER that Delta bought for $7.7 mln, will actually cost $67.7 mln to bring it to today's standards in terms of comfort and make it ready for service. This still is much cheaper than the $168.4 mln for the Boeing 787-10.

Costs for the D-Check will be accounted for in part 2 of this article series, which deals with maintenance costs.

The market value or purchase price alone already gives the Boeing 777-200ER a $100.7 mln advantage.

Insurance

The lower market value