In the September issue of Euromoney, Peter Lee has a huge investigation into what he calls "the great bond liquidity drought". The landing page for the story features subscriber-only links to the whole thing, as well as free-to-access links to various sections. But it also neatly summarizes the problem in a single paragraph:

Liquidity is drying up across the bond markets. Regulations designed to curtail banks' leverage have had the unintended consequence of also sharply reducing their ability and willingness to make markets in corporate and even government debt. New regulations on the leverage ratio that will reduce banks' repo funding books threaten to make matters even worse and to spread the drought from credit markets to rates, the underpinning of all financial markets. Secondary markets are close to a breakdown that will soon imperil the primary markets on which companies and sovereigns depend for funding. All that is masking the decay is the extraordinary actions of central banks.

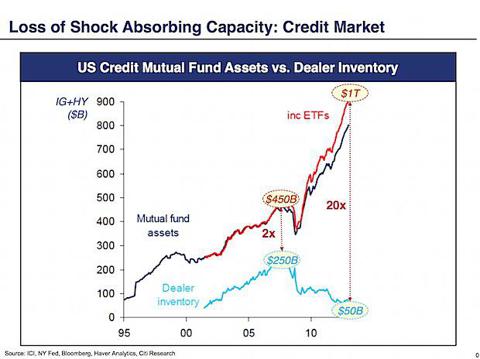

Here's a chart from Citigroup which helps show at least part of the story:

This chart doesn't just cover Citigroup (C), it covers all bond broker-dealers. They massively increased their inventory of bonds during the 2000s bubble - but so did everybody else: total credit assets were raising substantially over that period. Then, after the financial crisis, came the great divergence. Broker-dealers retreated from the market, even as investors continued to seek the safety of bonds. So while broker-dealers were about half the size of the credit mutual fund industry in 2007, according to the quantity of assets they owned, today they're only about 1/20th of the size. And those broker-dealers are still the only real liquidity providers in the market. If you want to buy or sell a bond on the secondary market, there's really only one way to do it: phone a bunch of broker-dealers, ask them to make you a market, and either accept