As the economy around the world is recovering, Delta Air Lines (NYSE:DAL) has now achieved stability in operating profits. Operating profits have consistently grown since 2011 through 2013. It is rapidly achieving many milestones as it is taking off. Delta was recognized by FORTUNE'S World's Most Admired Companies 2014 as the most admired airline for the third time in four years. DAL also made its place in the top 50 of FORTUNE magazine's World's Most Admired Companies 2014 list at number 48.

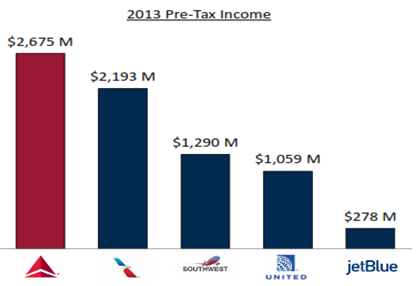

DAL outperformed its competitors in the airline industry, and has produced a higher pre-tax income. DAL produced a pre-tax income of around $2.7 billion, reflecting an increase of 71% on a year-on-year basis, and its pre-tax margins expanded by 2.8%. DAL's stock price grew by more than 130% during 2013, and it was the 4th-best performing stock in the S&P 500 index. This growth is expected to continue, as suggested by the trends in air travel that will be discussed below.

Air Travel has to Grow

Economists are forecasting robust growth in the emerging economies of Asia, Latin America, and Africa. Global companies are positioning themselves to capture the growth potential that these economies present. Boeing (BA) has published its outlook of the air travel industry for many decades, and this forecast acts as guidance for all of its allied companies. Boeing's 2013 industry outlook made a forecast for the next two decades until the year 2032. According to this forecast, top growth regions, including South Asia and China, will see a robust average annual growth rate of 6.6% and 6.4%. Southeast Asia, Africa, and Latin America will experience a good average annual growth between 4.7% and 4%. The graph below shows the expected growth in various regions of the world, as forecasted by Boeing.