The recent events of Chipotle (NYSE:CMG) should be analyzed from both perspectives, the potential buyer and the potential seller. This article touches three fundamental aspects of Chipotle that every shareholder and potential investor should know about the business. These three items are about the fundamentals of Chipotle, particularly the nature of the business costs and the quality of business capitalization. Furthermore, the article presents how this is going to affect the performance and expansion projects of the company going forward.

1) Chipotle has no debt, but it is still leveraged

There are two types of leverage that investors need to be aware of: financial leverage and operating leverage. Chipotle has zero financial leverage because it has no borrowings. However, Chipotle has a considerable degree of operating leverage. The degree of operating leverage represents the amount of fixed costs that Chipotle has to bear to run the business. Whether they sell one or millions of burritos, the fixed costs are going to stay the same. Fixed costs are rent, labor, utilities, and headquarters costs.

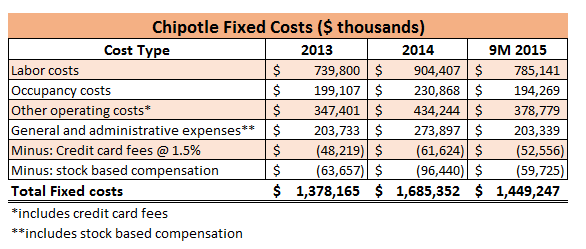

See the table below for a schedule of fixed costs. Note that I am only considering the costs that are going to result in cash outflows, thus eliminating share based compensation and excluding depreciation and amortization. Cash outflows are important for shareholders because it impacts free cash flows directly.

Credit card fees are variable costs that are incurred based on each credit card sale. Chipotle does not disclose the portion of sales that are done by credit card, but I suppose many people use credit cards. To give Chipotle the benefit of the doubt, I am considering every sale as a credit card sale. Based on normal credit card fees applied to businesses, 1.5% of sales for credit card costs seem reasonable.

Rent will not decrease because