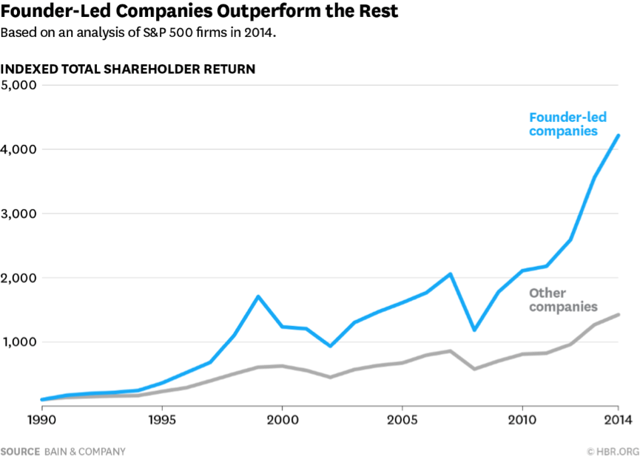

We believe that investing with founders gives you an edge in the stock market. Behind every stock, there is a company, and behind every company are people. Why not invest with the best, like Jeff Bezos and Mark Zuckerberg? Amazon (AMZN) and Facebook (FB) have outperformed for years, and they seem to be able to take risks and make investments most companies wouldn't be able to. We believe the main reason for this is the founders' long-term vision. Thankfully, Bain & Company have quantified the outperformance of founder-led firms. You can see below that they beat the index by 3.1x.

(Source: Founder-Led Companies Outperform the Rest - Here's Why)

The founder mentality = owner mindset

Bain's study found that when the founder was still CEO, the company generated 31% more patents, was more likely to make investments and had a willingness to take risks to better position itself for the future. These companies had a strong sense of purpose for servicing customers, and this purpose helped employees feel more engaged at work. The founders treated everything like their own money, because they had with large stakes in the business, and hated bureaucracy. It's hard to have a successful business, but it's even harder to keep growing into the future. The long-term view of founder-led companies meant that over time, they were positioned for change compared to managements with shorter time horizons (average S&P 500 CEO time horizon was 9.9 years in 2014) and little equity in the business.

The material in this article is for informational purposes only and in no way constitutes a solicitation of business or investment advice. The material has been prepared without regard to any client's or other person's investment objectives. Before making an investment decision you should consider the assistance of a financial adviser and whether any