Three of the largest publicly-traded companies in off-price retail are TJX (TJX) (operators of TJ Maxx, Marshalls and Home Goods), Ross Stores (NASDAQ:ROST) (operators of Ross Dress For Less and dd's Discounts) and Stein Mart (SMRT). TJX is the larger player with 2,689 stores in the US, followed by 1,446 for Ross and 278 for Stein Mart.

In the article below, I will make the case for why Ross Stores should acquire Stein Mart. This article will be of interest to investors seeking a potential takeover target (Stein Mart), investors in TJX who may face a stronger future competitor and existing investors in both Ross and Stein Mart.

A Stein Mart acquisition by Ross would be similar to the 1995 acquisition of Marshall's by TJ Maxx. That acquisition in 1995 was for $500 million. A Stein Mart acquisition by Ross in 2016 would likely cost less.

Minimal Geographic Overlap

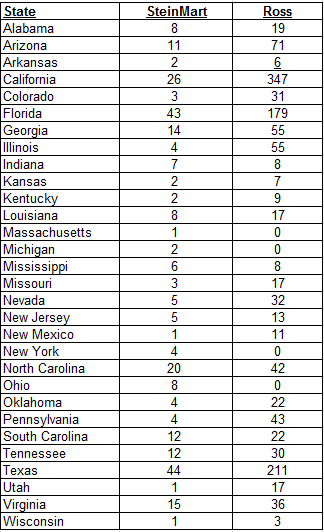

Ross and Stein Mart only operate stores in the United States. The table below shows the number of stores in states where Stein Mart and Ross both have a presence. States where Ross operates stores but Stein Mart does not are not listed here.

(Source: Ross Stein Mart)

- In four states where Stein Mart operates (Massachusetts, Michigan, New York & Ohio), Ross has no stores.

- In Ross's largest state, California, Stein Mart has less than 10% of the stores as Ross (347 vs. 26).

- Ross has a small presence in Illinois, Nevada, New Jersey & Pennsylvania; large states with large populations. Stein Mart would provide additional stores in those markets.

By acquiring Stein Mart, Ross would gain entry into four new states, likely have minimal overlap in their largest market (California), and strengthen their footprint in four large states with large populations.

Ross and Stein Mart both have decent footprints