Introduction

BHP Billiton (NYSE: NYSE:BHP) is an Anglo-Australian multinational mining, metals, and petroleum company headquartered in Melbourne, Australia. The company is the world's largest mining company by value with a market cap of more than $75 billion compared to its 2011 pre-commodity crash highs when the company reached a market cap of more than $250 billion. The company's dual exposure to the mining and oil industries meant the company's share price began dropping in 2011 before taking a much larger downturn after the 2014 oil crash.

BHP Billiton Logo - Daily Reckoning

After peaking at just under $30 per share, BHP Billiton's share price experienced an impressive run up to roughly $100 per share in 2011. However, at that point, the company's share price began dropping and the company spent 2012 to 2014 at roughly $70 per share. However, when the oil crash started in mid-2014, the company's share price took a much larger hit.

From mid-2014 to early-2016, when oil prices hit their bottom, BHP Billiton saw its share price drop from roughly $70 per share to less than $20 per share. However, since that bottom, BHP Billiton has seen its share price recover by more than 50% to present prices of more than $30 per share. Despite this impressive recovery, I still believe that BHP Billiton has some attractive prospects at its current price.

June 30 Year End Financial Results

Now that we have an overview of BHP Billiton, it is now time to discuss the company's year end financial results.

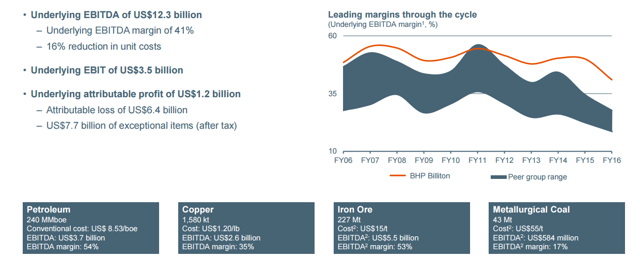

Year End Financial Results - BHP Billiton Investor Presentation

For a company with a $77 billion market cap, BHP Billiton had impressive underlying EBITDA of $12.3 billion for 2016 with an underlying EBITDA margin of 41%. The company managed to reduce its unit costs by 16%. However, when removing the company's depreciation and