Ten years ago, fertilizer companies were all the rage in investing. Margins and profits were soaring each quarter, supplies were tight, demand was strong, and the stock prices of companies like Potash (POT), Mosaic (MOS) and Agrium (AGU) seemed to rise every day. Today the outlook for these companies is represented by a much different landscape. Margins are tight, fertilizer supplies are high across all sectors (potash, phosphate and nitrogen) and the stock prices for these companies are hitting lows not seen in nearly a decade. However, a sign of a bottom approaching may be at hand. Recently, Potash and Agrium announced that they are pursuing a merger with one another. This opens the door to a company that could potentially become the largest fertilizer provider in the world, as well as a company that would enjoy additional pricing power and access to new markets. This article examines these aspects of a potential merger and discusses the implications if it actually occurs.

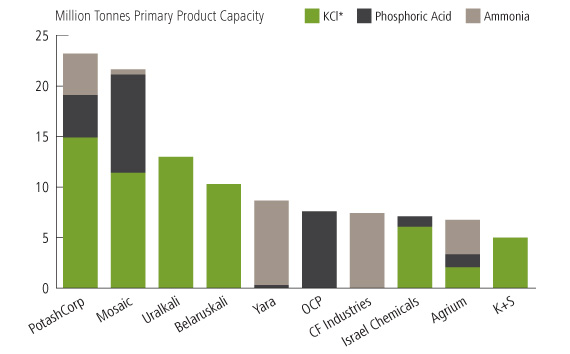

A merger between Potash and Agrium is a merger between two companies that would truly complement each other. Potash has huge production capabilities, yet most of its products are sold wholesale. Agrium is one of the smallest production companies in the fertilizer space, yet has the largest retail distribution network in North America. As you can see below, combining these two companies would, in fact, create the largest fertilizer conglomerate in the world.

Potash could realize much higher margins by selling products directly to the retail market through Agrium's distribution networks, and Agrium would be able to offer much larger quantities of product, specifically potash, to its customer base. The result would be much higher operating margins and greater product distribution for these companies.

While a merger appears quite appealing for shareholders and their respective companies, the farmer, and ultimately