Source : US Department of Energy

Only a month ago I wrote about the quickening pace of the wind industry both on- and off-shore. A lot is changing for offshore wind and it all looks positive after years of uncertainty in the US.

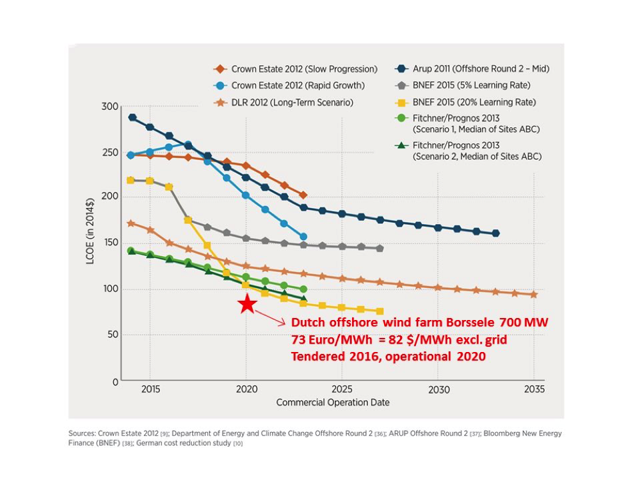

This week Swedish Government owned power company Vattenfall trumped Dong Energy's (DC:DENERG) recent record low bid of $73/MWh, by bidding Euro $60 ($67.47)/MWh for two offshore wind farms. This is 20% lower than Dong Energy's bid. The dramatic reduction in cost of offshore wind is evident in the following figure, with the Dutch, Dong Energy project indicated in red. The Vattenfall project is not on the figure but it sits 20% below the Dong project.

The Vattenfall farms are special (cheaper) because they are close to the Danish coast. The Danish Government still needs to approve the tenders, but if approved the windmills could commence operation in 2020, with a capacity of 350 MW.

This week the US Government released a National Offshore Wind Strategy to stimulate offshore US wind developments. The report has a 34 year horizon and it envisages 86 GW of offshore wind by 2050, which is a long way from 30 MW today.

The National Offshore Wind strategy document says almost 80% of US energy demand is located in coastal cities which offshore wind could service. There is the capacity to generate twice the power needed to service these cities. Holdups have been cost, technical risk, regulation, environmental risk & better understanding of cost/benefit.

While the new national strategy is a big picture document, at the end of last month a new energy bill in the Massachusetts House and Senate mandated long term (at least 15 years) power purchase of up to 1.6 GW of offshore-produced wind power. The deadline is tight and because only two commercial