The stock market is frequently considered a leading indicator of future economic developments. A rising stock market signals an (expected) improving economy while a declining one signals an economy heading for the worse.

Viewing the stock market this way is logical, at least in theory, as stock market participants, we've been told, discount expected future economic developments when forecasting corporate earnings and discount rates. Unfortunately, a rising stock market does not forecast an improving economy, if by "improving" we mean economic growth, i.e. an improvement in living standards.

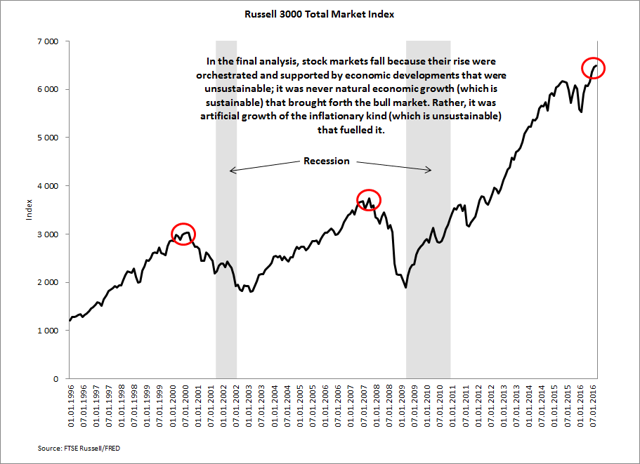

Contrary to popular opinion, an ever-rising stock market is not an indicator of a prospering economy. What a rising stock market however is an indicator of is rising corporate earnings, increased demand for stocks, and falling discount rates. As aggregate corporate earnings, ultimately fueled by increased consumer spending, cannot forever expand without an inflating money supply, and as interest rates would rise with increased consumer spending and a reduction in savings if the money supply was inelastic, a rising stock market is in fact predominantly a reflection of monetary inflation.

But increased monetary inflation is no gauge of increased prosperity. If anything, it's the opposite. Instead of bringing forth economic prosperity, monetary inflation distorts prices and the saving-investment relation, it makes instant gratification possible which puts downward pressure on the rate of saving, and it undermines, and sometimes destroys, the functions, including the value, of money.

Monetary inflation facilitates malinvestments and overconsumption, and it complicates sound capital formation. Market participants are hence wrong in viewing a rising stock market as an indicator of current and future economic growth to the extent they mistakenly confuse monetary inflation (and the increases in GDP, corporate earnings and other economic aggregates measured in monetary terms it brings about) with a prospering economy.

A range of economic