Upcoming Earnings Release

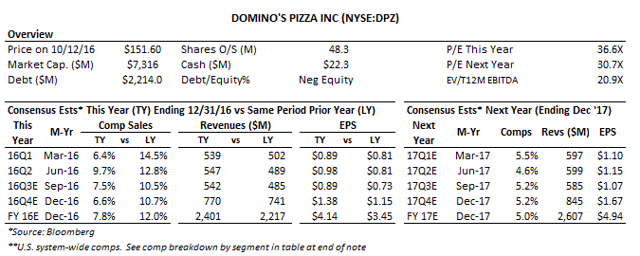

Domino's Pizza (NASDAQ:DPZ) is scheduled to report its 16Q3 earnings Tuesday, October 18th before the market opens with a conference call at 10:00AM EST. Per Bloomberg LP: of the 16 sell side analysts providing estimates, the consensus revenue, comps and EPS of $542M, 7.5% and $0.89, respectively, are unchanged or slightly higher (notably comp estimates, up 50bps) in the past 2 months. Q4 and FY17 estimates have also been rising revised upwards this year as DPZ has delivered strong results. According to Bloomberg, the median target price is $154 (range $120 to $153), also increasing consistent with results. Domino's Pizza Group plc, the master franchise for the UK and Republic of Ireland (£900M system sales and >900 units), today reported Q3 system comps ~4.0% and renewed its outlook for the year despite H2 challenges.

DPZ: Company Overview

Domino's Pizza is an Ann Arbor, Michigan-based pizza restaurant chain, which, per its '16Q2 quarterly report, operated and franchised 12,936 units globally, generating an estimated $9.5B in sales (about 1.5M pizzas/day), making it the world's second largest pizza chain (after Pizza Hut) and the number one U.S pizza delivery company. About half the sales are produced by the 5,245 domestic stores (386 company, 4,859 franchised), while the other half are produced by franchised stores in over 80 markets around the world.

In the T12M through 16Q2 DPZ's revenues were $2.3B which were derived from company stores (18%), royalties and fees from franchisees (12% domestic, 7% international) , with the remaining 63% from sales of food supplies and equipment to company and franchise locations. We estimate the AUV's of company units are slightly over $1M (or about $700/sq. ft., assuming average store size of 1,500 sq ft). Disclosed store-level operating margins (which include depreciation but not advertising expense) are about 25%, while royalties from domestic and international franchisees are almost pure profit. We estimate domestic and international franchised unit AUV's are about