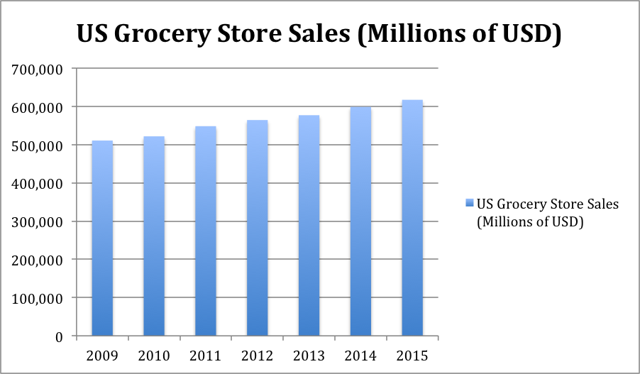

Everyone knows the drill. We've all done it at least once a week for most of our lives. You stop at the store on the way home to pick up a few missing ingredients for dinner; or you make your list and head to the store on the weekend to do your big weekly shopping trip. It is these shopping trips that helped to make the US grocery market an industry that brought in over $600 billion in revenue in 2015. The market continues a trend of slow and steady growth since 2009, up about 2% year to date over last year.

(Source: YCharts)

These grocery sales are made up of two primary types of grocery brands. There are the national brands, such as Cheerios, Nabisco, Frito-Lay, etc., and then the private-label brands. National brands spend lots of money developing and marketing their products so that consumers will purchase them assuming that they are getting a better-quality product. Because of this money spent on advertising as well as the consumer belief of greater quality, national brands charge more for their products than the private-label products.

Changing the way people feel about private-label brands

Growing up, store-brand products always seemed to have a stigma of being "lower-quality". It always seemed that you get what you pay for. The store-brand products were cheaper for a reason; therefore, it was worth it to pay a little more for a national brand in order to get a quality product. However, stores seem to have caught on to that and have been working diligently over the past few years, creating higher-quality store-brand items that provide the customer with a lower-cost option without sacrificing quality. It seems that every store you go into these days has a higher-quality or natural/organic store brand sitting right next to the national brands consumers are already familiar with.