National Storage Affiliates (NYSE:NSA) is outperforming its larger peers and is currently the only storage REIT that is outperforming the S&P 500 in 2016.

National Storage Affiliates is a roll-up of regional storage operators that went public in 2015. Since its IPO, it has added an additional regional operator and grown the total portfolio with a plethora of relationship driven acquisitions. While it is much smaller than its peers, the NSA growth story is becoming well known in the storage industry. Its business model is based on acquiring cash flowing properties, cutting costs and improving margins. Given its early success, NSA appears well positioned to continue growing at a rapid pace.

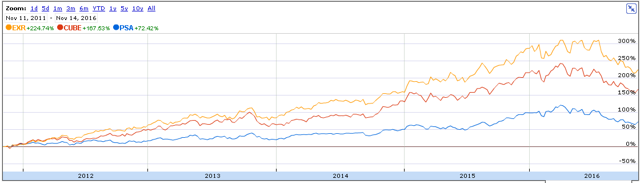

Storage REITs have been the best performing REIT (Real Estate Investment Trust) category over the past five years. Growing demand for storage has helped storage REITs achieve good margins and perform relatively well in a low growth environment. While the success of National Storage Affiliates is noteworthy, it also helps to understand how its larger peers have performed.

Storage REITs such as Public Storage (NYSE: PSA) Extra Space Storage (NYSE: EXR) and CubeSmart (NYSE: CUBE) performed very well from 2011 to 2015. However, the major storage REITs have pulled back significantly since mid-2016.

Source: Google Finance

The pullback over the last six months has brought frothy multiples back to earth and nearly every storage REIT is currently down YTD. While the threat of rising interest rates appears to be making an impact, storage REITs also have experienced softening fundamentals that appear to be impacting their stock prices.

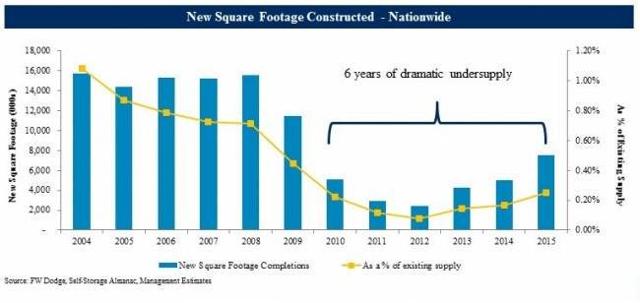

The greatest fundamental threat has been additional supply of new facilities. While new supply had been constrained for years, 2016 is shaping up to be the first year with an ample supply of new facilities coming to market.

Source: Jernigan Capital

While